- Understanding Binary Options Trading in India

- Top Binary Options Platforms for Indian Traders

- Payment Methods for Indian Binary Options Traders

- Low Minimum Deposit Options for Indian Traders

- Trading Indian Markets with Binary Options

- Mobile Binary Trading for Indian Users

- Binary Options Education in Hindi and English

- Demo Accounts for Indian Binary Options Traders

- Tax Implications for Indian Binary Options Traders

- Frequently Asked Questions

Understanding Binary Options Trading in India

Binary options trading is like placing a smart bet. You predict if an asset’s price—say, gold or USD/INR—will go up or down by a certain time. If you’re right, you pocket a fixed payout, often 70-95%. If you’re wrong, you lose what you put in. It’s simple, fast, and exciting, which is why Indian traders are hooked. But before you dive in, you’ve got to understand the rules, risks, and how it fits into India’s financial landscape.

The beauty of binary options is the clarity. There’s no guesswork about how much you’ll gain or lose. Yet, it’s not a game—it demands discipline and research. In India, the appeal is strong because you can start small, even with ₹500, and trade assets tied to the local economy. Just don’t expect quick riches; success takes time and strategy.

Legal Status and RBI Guidelines

Is binary options trading legal in India? That’s the million-rupee question. The Reserve Bank of India (RBI) doesn’t directly regulate binary options, leaving it in a murky zone. Under the Foreign Exchange Management Act (FEMA), sending money overseas for speculative trading without RBI approval is a no-go. Many offshore brokers operate here, but some get flagged on the RBI’s alert list for unauthorized forex dealings.

So, what’s the deal for traders? You can trade with international brokers, but you need to be sharp. The RBI allows forex transactions through authorized dealers for things like travel or education, but binary options don’t fit neatly into those categories. If you send money to a sketchy broker, you risk FEMA violations—think fines or legal hassles. I’ve seen traders get burned by ignoring this.

SEBI Regulations and Implications

The Securities and Exchange Board of India (SEBI) oversees stocks and commodities, but binary options? They’re outside SEBI’s scope. No local brokers are SEBI-licensed for binary trading, so you’re dealing with offshore platforms. That’s not necessarily bad, but it means no SEBI safety net if things go south.

What does this mean for you?

- Higher Risk: Without SEBI oversight, you rely on the broker’s reputation.

- Due Diligence: Verify licensing, read reviews, and test support before depositing.

- Global Standards: Look for brokers regulated by trusted bodies like CySEC.

I’ve seen traders lose money to shady brokers promising big returns. Stick to platforms with transparent terms and proven track records. It’s your money—protect it.

Top Binary Options Platforms for Indian Traders

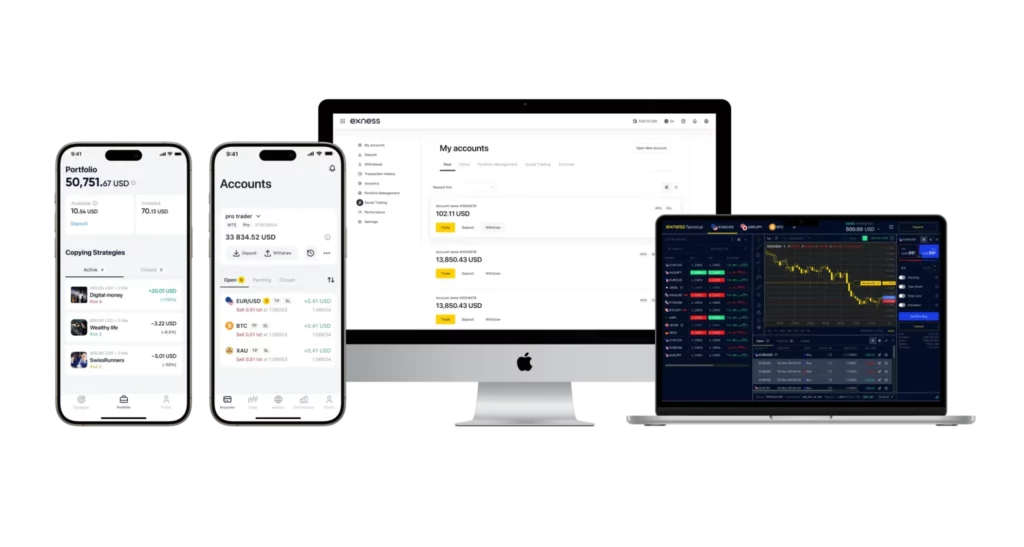

A good broker feels like a trading partner. For Indian traders, that means low deposits, local payment options, and assets like USD/INR or Nifty. After years of trading, here are my top picks for 2025, including Exness for its India-friendly features:

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| No fees | CFDs (Forex 100+ pairs, Cryptos, Commodities, Indices, Stocks) | $10 | Up to 1:2000 | MT4 MT5 Exness Terminal Exness Trade App | ||

| No commission | Currency pairs Commodities Cryptos OTC | $5 | 1:10 to 1:1000 (MT5 Forex, deposits >$1,000) | MT5 Proprietary web Mobile | ||

| No trading/deposit/withdrawal fees | Currency pairs Commodities Cryptos Indices (43 total) | $10 | Not available | Proprietary browser platform Android app | ||

| Spread: 1.7-1.9 points; Withdrawal: 2% | CFDs (Stocks, ETFs, Commodities, Indices, Cryptos, Forex, Options) | $10 | Up to 1:500 (Forex) | IQ Option proprietary Mobile | ||

| Up to 15% standard trades, 10% FTT | Forex CFDs Stocks Indices Commodities Cryptos ETFs OTC Fixed Time Trades | $10 | Varies by region/market | Olymptrade (web, desktop, mobile) No MT4/cTrader |

Each has quirks. Exness shines for low-cost forex trades, while IQ Option is great for beginners. Pocket Option’s asset variety is a plus, but their bonuses have strings attached. Test their demos to find your fit. And skip brokers hyping “easy money”—they’re usually scams.

| Broker | Minimum Deposit | Assets Available | Regulation | Demo Account |

| Exness | $10 (~₹800) | Forex, CFDs, USD/INR, stocks | CySEC, FCA | Yes |

| IQ Option | $10 (~₹800) | Forex, stocks, commodities | CySEC | $10,000 |

| Pocket Option | $50 (~₹4000) | 100+ assets, Indian stocks | IFMRRC | Yes |

| Quotex | $10 (~₹800) | Forex, crypto, high payouts | None (reputable) | Yes |

| Olymp Trade | $20 (~₹1600) | Stocks, forex, commodities | IFC | Yes |

Pro Tip: Use X to search for real-time trader feedback on these brokers. A quick query like “Exness India review” can reveal red flags or perks.

Payment Methods for Indian Binary Options Traders

Funding your account should feel effortless. In India, that means brokers need to support UPI, NetBanking, or Paytm—not just Visa or Skrill. Costs and speed matter too. Let’s break down the best ways to deposit and withdraw in 2025.

UPI Integration

UPI is India’s payment superstar. It’s instant, free, and works with apps like Google Pay, PhonePe, or BHIM. Brokers like Exness, Quotex, and IQ Option have jumped on board, letting you deposit ₹500 or more in seconds. Withdrawals take 1-3 days, which beats most alternatives. The catch? Not all brokers offer UPI, and some limit it to deposits only.

Why I love UPI:

- Speed: Funds hit your account instantly.

- No Fees: Most brokers don’t charge for UPI transactions.

- Accessibility: Everyone in India uses it, from Mumbai to Madurai.

Before signing up, confirm UPI is available for both deposits and withdrawals. It’s my first choice for small trades.

NetBanking Options

NetBanking is a trusty option, especially for deposits above ₹5000. Brokers like Exness, Pocket Option, and Olymp Trade support transfers from banks like HDFC, SBI, or Axis. It’s secure, but deposits take 1-2 days to clear, and withdrawals can stretch to 4 days. Fees are minimal—₹50-₹150—but vary by broker and bank.

NetBanking suits traders who don’t mind waiting. I use it for larger deposits when I’m planning a big trading session. Just double-check the broker’s bank list to ensure yours is included.

Indian Credit/Debit Card Processing

Credit and debit cards (Visa/Mastercard) are universal, and brokers like Exness, IQ Option, and Quotex accept them. Deposits are instant—perfect for grabbing a trade opportunity. But withdrawals crawl, often taking 3-5 days, and fees can hit 2-3%. If the broker doesn’t support INR, you’ll lose more to currency conversion.

Cards are fine for quick deposits, but I’d pick UPI for regular use. Always review the broker’s fee schedule to avoid surprises.

E-Wallets Popular in India

E-wallets like Skrill, Neteller, and Paytm are fast and trader-friendly. Exness and Pocket Option support Skrill and Neteller, processing transactions in 24 hours. Paytm is rarer but popping up on platforms like Quotex. Fees range from 1-2%, and INR support skips conversion costs. They’re great for traders who juggle multiple accounts.

Cryptocurrency Alternatives

Crypto is a wildcard. Brokers like Pocket Option and Quotex accept Bitcoin, Ethereum, or USDT. Deposits take 10-30 minutes, depending on the blockchain, and fees are low—often under ₹100. But crypto’s price swings can mess with your balance, and INR withdrawals aren’t always available. It’s a solid option if you’re crypto-savvy, but UPI or e-wallets are less hassle for most.

| Payment Method | Deposit Time | Withdrawal Time | Fees | Pros | Cons |

| UPI | Instant | 1-3 days | None | Fast, free, widely used | Not universal |

| NetBanking | 1-2 days | 2-4 days | ₹50-₹150 | Secure, reliable | Slow processing |

| Credit/Debit | Instant | 3-5 days | 2-3% | Instant deposits | High fees, conversion |

| E-Wallets | Instant | 24 hours | 1-2% | Fast, flexible | Limited INR support |

| Crypto | 10-30 mins | 1-2 days | Varies | Low fees, anonymous | Volatile, complex |

Trader Hack: Mix UPI for deposits and e-wallets for withdrawals to balance speed and cost. Exness’s UPI integration is a standout here.

Low Minimum Deposit Options for Indian Traders

Starting small is the way to go in binary options. Low minimum deposits let you learn without risking your savings. India’s cost-conscious traders need brokers that keep entry barriers low and offer value. Here’s how to pick wisely.

Platforms with ₹500-₹1000 Minimum Deposits

Brokers like Exness, IQ Option, and Quotex start at $10 (~₹800), perfect for beginners. You can trade as little as $1 per position, stretching your funds. All three offer free demos—Exness gives you $10,000 virtual funds to practice. Withdrawal fees (₹50-₹100) can bite, so plan your cashouts carefully.

Top picks:

- Exness: UPI deposits, $1 trades, and tight spreads.

- IQ Option: Beginner-friendly with a polished demo.

- Quotex: High payouts (up to 95%) and simple design.

These platforms let you dip your toes without diving in deep. I started with ₹1000 years ago—it’s enough to learn if you’re disciplined.

₹1000-₹5000 Deposit Range Brokers

Ready to scale up? Pocket Option ($50, ~₹4000), Olymp Trade ($20, ~₹1600), and Exness ($10, but flexible for higher deposits) fit the bill. You get more assets—think Indian stocks or gold—plus advanced tools like candlestick charts or indicators. Some dangle bonuses (10-30% extra), but they often lock your funds until you trade a ton. I’d skip them unless you’re confident.

| Broker | Deposit Range | Trade Size | Strengths | Weaknesses |

| Exness | ₹800-₹5000 | $1+ | UPI, forex variety, reliable | Limited binary focus |

| IQ Option | ₹800-₹5000 | $1+ | Demo, app quality | Withdrawal fees |

| Pocket Option | ₹4000-₹5000 | $1-$5 | Asset range, bonuses | Bonus terms tricky |

| Olymp Trade | ₹1600-₹5000 | $1-$5 | Charting tools, education | Slower withdrawals |

Making the Most of Small Deposits

A small deposit isn’t a small opportunity—it’s a training ground. With ₹1000, you can place 20 trades at ₹50 each, enough to test strategies. Focus on high-volatility assets like USD/INR or gold for quick moves. Trade short-term (1-5 minutes) to maximize chances. Risk no more than 5% per trade to avoid wiping out fast.

How to stretch your funds:

- Pick One Asset: Master USD/INR before chasing Nifty or stocks.

- Use Demos: Practice setups until you’re consistent.

- Track Trades: Note what works and what flops to improve.

- Avoid Greed: Chasing losses with big bets kills accounts.

Last month, I mentored a trader who turned ₹2000 into ₹3500 in two weeks by sticking to 3% risk and USD/INR trades. Patience pays.

Trading Indian Markets with Binary Options

India’s markets are full of potential for binary traders. You can tap into indices, forex, or commodities tied to the economy. Here’s what’s worth trading.

Nifty and Sensex Options

Nifty 50 and Sensex drive India’s markets. Brokers like Exness and IQ Option offer CFDs or binary options linked to them. You bet if Nifty will climb or drop within, say, an hour. News like RBI rate changes or earnings reports spikes volatility, making these trades tempting. They’re tricky, so practice first.

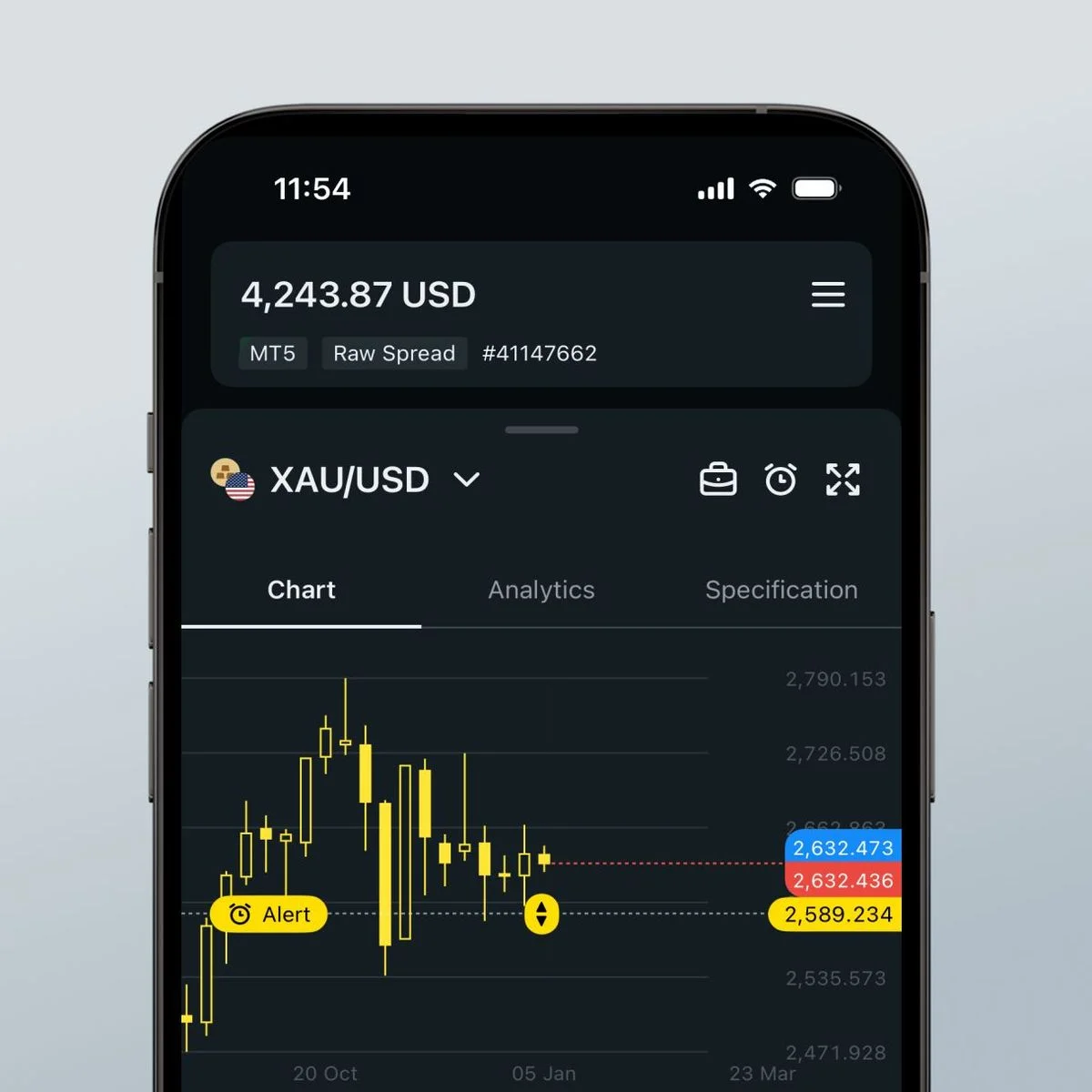

USD/INR Currency Pairs

USD/INR is a go-to for Indian traders. It moves with global events or RBI policies. Exness and Pocket Option list this pair, letting you trade short-term (30 seconds to 5 minutes). Spreads can widen during news, so check your broker’s terms. I like it for quick, predictable trades.

Indian Stock CFDs

Trade stocks like Reliance or Infosys via CFDs on platforms like Exness or Pocket Option. You don’t buy shares—just predict price moves. It’s great for day trading, but liquidity varies. Confirm your broker offers Indian stocks before diving in.

Commodity Options Important to Indian Economy

Gold, silver, and crude oil matter to India’s economy. Exness and Quotex let you trade binary options on them. Gold jumps during festivals or global uncertainty, while oil reacts to supply news. Bet on whether silver hits a price target by evening—it’s exciting but needs research.

| Asset | Best Brokers | Trade Type | Volatility Driver |

| Nifty/Sensex | Exness, IQ Option | CFDs, Binary | RBI news, earnings |

| USD/INR | Exness, Pocket | Binary | Global events, RBI policy |

| Indian Stocks | Exness, Pocket | CFDs | Company results |

| Gold/Silver/Oil | Exness, Quotex | Binary | Festivals, global supply |

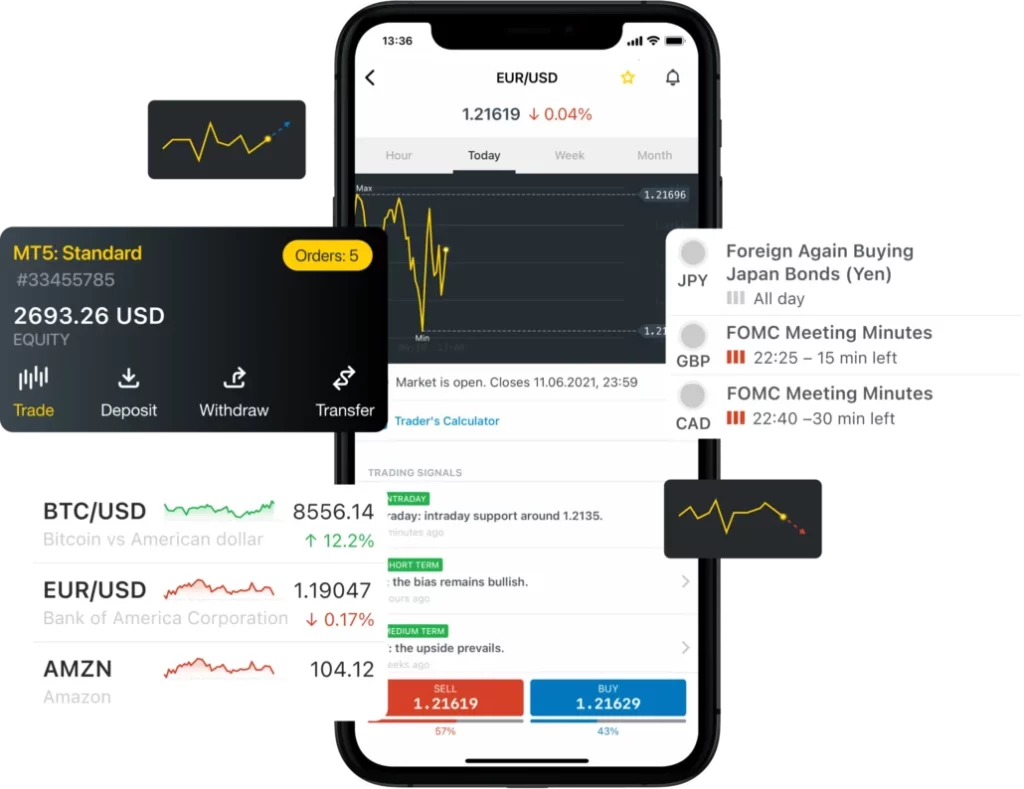

Mobile Binary Trading for Indian Users

In 2025, your phone is your trading desk. Brokers like Exness, IQ Option, and Pocket Option deliver apps for Android and iOS that pack a punch. Exness’s app offers real-time charts, UPI deposits, and USD/INR trades in a snap. IQ Option’s is silky-smooth for beginners, with tutorials built in. Pocket Option’s app is fast but can lag on older phones.

Why mobile matters:

- Trade Anywhere: Bus, café, or couch—your call.

- Real-Time Alerts: Catch Nifty moves or RBI news instantly.

- Easy Funding: Deposit via UPI without a laptop.

Test the app before committing. A glitchy platform can cost you a trade. I lost ₹2000 once because an app froze during a USD/INR spike—lesson learned. Stick to secure Wi-Fi, and enable two-factor authentication to keep hackers out.

Binary Options Education in Hindi and English

Learning to trade binary options is key. Without it, you’re just tossing coins. In India, Hindi and English resources make it easy to understand charts, risks, and assets like USD/INR. Good education saves money and builds confidence. Let’s see what’s available to help you start strong.

You don’t need fancy degrees—just clear guides or videos. Brokers offer free stuff to get you going. I learned trading from simple tutorials. You can too.

Hindi Trading Tutorials

Hindi tutorials are perfect for many Indian traders. English can feel tough, especially with words like “resistance” or “expiry.” Brokers like Exness, IQ Option, and Olymp Trade have Hindi videos and blogs. They explain basics like placing trades or reading price moves.

Exness offers Hindi YouTube clips on forex pairs like USD/INR. IQ Option’s app has short Hindi lessons on charts. Olymp Trade runs Hindi webinars weekly. Start with these:

- Exness Videos: Quick tips on forex.

- IQ Option App: Easy chart guides.

- Olymp Trade Webinars: Live Q&A in Hindi.

I watched a Hindi video on Exness about trends and nailed my first trade. Pick short clips—10 minutes—and practice on a demo to lock in what you learn.

India-Specific Strategy Guides

India’s markets are unique. Nifty doesn’t act like global indices, and USD/INR jumps on RBI news. Guides made for India focus on local stuff—like gold during Diwali or Sensex after budgets. Exness and Pocket Option have these in Hindi and English.

What you’ll learn:

- Trading Nifty or Indian stocks.

- Catching USD/INR moves on news.

- Why gold spikes in festivals.

- Handling small budgets like ₹1000.

Pocket Option’s guide on USD/INR helped me trade 1-minute options during rate changes. Exness’s blog on gold is great for festive seasons. Check X for “India trading tips” too. Test every strategy on a demo first—it’s free.

| Resource | Brokers | Language | Best For |

| Hindi Tutorials | Exness, IQ, Olymp | Hindi | Beginners, basics |

| India Guides | Exness, Pocket | Hindi/Eng | Local markets, news |

Demo Accounts for Indian Binary Options Traders

Demo accounts are your training wheels. They let you trade with virtual money—no risk, all reward. For Indian traders, demos are a must to master platforms, test strategies, and get comfy with assets like USD/INR or Nifty before betting real rupees. Every broker worth their salt offers one, and they’re free.

Exness, IQ Option, Pocket Option, Quotex, and Olymp Trade all provide demos with $10,000 virtual funds (or more). Exness’s demo mirrors their live platform, so you can practice USD/INR trades with real-time spreads. IQ Option’s is great for beginners—clean interface, no pressure. Pocket Option throws in 100+ assets, including Indian stocks, while Quotex and Olymp Trade let you tweak expiry times to match your style.

Why use a demo?

- Learn the Platform: Navigate charts, place trades, set expiries.

- Test Strategies: Try trading Nifty during news without losing money.

- Build Confidence: Make mistakes now, not with your ₹1000 deposit.

- No Cost: Free to use, no strings attached.

I spent a month on IQ Option’s demo before going live. Practiced USD/INR trades, lost thousands of virtual bucks, but learned to spot trends. When I started real trading, I was ready. Spend at least 10 hours on a demo—it’s like learning to drive before hitting the road.

One catch: demos feel easier because there’s no emotional stake. Real trading hits different, so don’t get cocky. Pick a broker like Exness or Quotex, where the demo matches the live experience closely. Reload the virtual funds if you “bust” and keep practicing.

| Broker | Demo Funds | Assets Available | Unique Feature |

| Exness | $10,000 | Forex, CFDs, USD/INR | Real-time spreads |

| IQ Option | $10,000 | Forex, stocks, gold | Beginner-friendly UI |

| Pocket Option | $10,000 | 100+ assets, Indian stocks | Flexible expiry times |

| Quotex | $10,000 | Forex, crypto, commodities | High payout simulation |

| Olymp Trade | $10,000 | Stocks, forex, indices | Built-in tutorials |

Tax Implications for Indian Binary Options Traders

Profits from trading are awesome, but taxes are real. In India, binary options income has rules. Knowing them keeps you out of trouble with the taxman. Let’s break it down.

Foreign Exchange Regulations

The RBI closely monitors money leaving India through FEMA regulations. When you use binary options, the brokers are often based offshore, meaning you’re transferring money abroad. This can be tricky, as FEMA only allows transfers for specific purposes like travel or education, not always for trading. To avoid issues, it’s important to follow the proper channels.

To stay on the safe side, make sure to use banks approved by the RBI and choose reputable brokers like Exness, which ensures legitimate payments. It’s also wise to keep all receipts and trade records handy. If you transfer a large amount, such as ₹10,000, to an unreliable broker, you could draw unwanted attention. Exness, however, uses the correct payment channels, so I feel confident using them. Always save your records, just in case the RBI asks for them.

Reporting Requirements for Indian Residents

Your trading profits are taxed as business income or “other sources.” Report them on ITR-3 or ITR-4 by July 31. Taxes depend on your slab—5-30%. Losses can cut your tax, but you must declare them.

Steps to follow:

- Log every trade and withdrawal.

- File ITR correctly—CA helps.

- Pay advance tax if profits are big.

Earn ₹50,000 profit? At 20% slab, you owe ₹10,000 tax. I track trades in a notebook and use Exness’s history for proof. Get a CA if profits grow—it’s worth it.e events draw dozens of traders. These platforms aren’t just for trading—they’re sparking connections.

Frequently Asked Questions

New to binary options? Here are quick answers to what Indian traders ask most.

Is binary options trading legal in India?

It’s not clear-cut. RBI doesn’t regulate it, and FEMA limits overseas transfers. You can trade with brokers like Exness, but use licensed ones. Check RBI’s alert list to stay safe.