- The US Binary Options Trading Landscape

- Top Binary Options Platforms Accepting US Traders

- Offshore Binary Brokers for US Traders

- Trading Features Important for US Clients

- Binary Options Alternatives for US Traders

- State-Specific Binary Options Regulations

- US Trader Protection and Security Measures

- Tax Implications for US Binary Options Traders

- Frequently Asked Questions

The US Binary Options Trading Landscape

The US binary options scene is a tough nut to crack. Rules are strict, and choices are slim compared to Europe or Asia. But that doesn’t mean you’re out of luck. If you understand the lay of the land, you can find opportunities that fit your style. Let’s dig into what’s legal, what’s restricted, and how to work around the roadblocks.

Current Legal Status

Binary options trading is legal in the US, but it comes with big asterisks. The government keeps a tight leash to protect traders from shady operators. Only a few platforms, like Nadex (North American Derivatives Exchange) and Cantor Exchange, have the green light to offer binary options domestically. These are fully regulated, so you’re safe using them, but their offerings can feel limited—fewer assets, stricter payouts. Offshore brokers? That’s where things get murky. It’s not illegal for Americans to trade with them, but the brokers themselves aren’t supposed to target US clients without CFTC approval. Many traders still use platforms like Pocket Option or Quotex, and while they’re accessible, you’re stepping into a gray area. My advice? Research hard. Check forums, read reviews, and never trust a broker that feels too good to be true.

CFTC Regulations and Limitations

The Commodity Futures Trading Commission (CFTC) is the gatekeeper for binary options in the US. Their job is to keep trading fair and transparent, but that comes at a cost—fewer options for traders. The CFTC only allows regulated exchanges like Nadex to operate, and they enforce strict rules on how binary options work. For starters, you can’t trade the same exotic contracts you’d find overseas. Leverage is capped, and brokers can’t market directly to Americans unless they’re CFTC-approved. That’s why you won’t see flashy ads from offshore platforms in the US. It’s frustrating, especially if you’re used to more open markets elsewhere, but the rules exist to cut down on fraud.

Alternative Trading Formats for US Residents

If binary options feel too boxed in, there’s no shortage of alternatives. The US market is packed with ways to trade that give you similar thrills without the CFTC’s heavy hand. Forex trading is a big one—you can bet on currency pairs with high leverage and quick turnarounds. Contracts for Difference (CFDs) let you speculate on everything from stocks to crypto without owning the asset. Then there’s traditional options trading, like calls and puts on stocks, or even futures for the bold. Each has its own learning curve, but they’re all more accessible than binaries in some ways. The trick is finding one that matches your risk appetite and trading goals.

Here are some alternatives worth exploring:

- Forex trading: Trade currency pairs like EUR/USD with tight spreads and high leverage.

- CFDs: Bet on price moves in stocks, commodities, or crypto—flexible but risky.

- Stock options: Buy calls or puts through US brokers like TD Ameritrade for more control.

- Futures: Higher stakes, but available on regulated exchanges like CME.

Start small, test the waters, and don’t dive into anything without a strategy. These markets can reward you, but they’ll punish sloppy moves just as fast.

Top Binary Options Platforms Accepting US Traders

Good brokers are hard to come by for US traders, but they’re out there. The best ones balance regulation, ease of use, and features that make trading smooth. Whether it’s offshore platforms or regulated exchanges, here’s what you need to know about the top picks in 2025.

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| No fees | CFDs (Forex 100+ pairs, Cryptos, Commodities, Indices, Stocks) | $10 | Up to 1:2000 | MT4 MT5 Exness Terminal Exness Trade App | ||

| No commission | Currency pairs Commodities Cryptos OTC | $5 | 1:10 to 1:1000 (MT5 Forex, deposits >$1,000) | MT5 Proprietary web Mobile | ||

| No trading/deposit/withdrawal fees | Currency pairs Commodities Cryptos Indices (43 total) | $10 | Not available | Proprietary browser platform Android app | ||

| 1% per transaction | Currency pairs CFDs Binary Options | $250 (Bronze); $500 (Silver); $2,500 (Gold); $50,000 (VIP) | Not specified | Webterminal BinaryCent platform Mobile apps (iOS, Android) | ||

| Spread: 1.7-1.9 points; Withdrawal: 2% | CFDs (Stocks, ETFs, Commodities, Indices, Cryptos, Forex, Options) | $10 | Up to 1:500 (Forex) | IQ Option proprietary Mobile |

Regulated Offshore Brokers for Americans

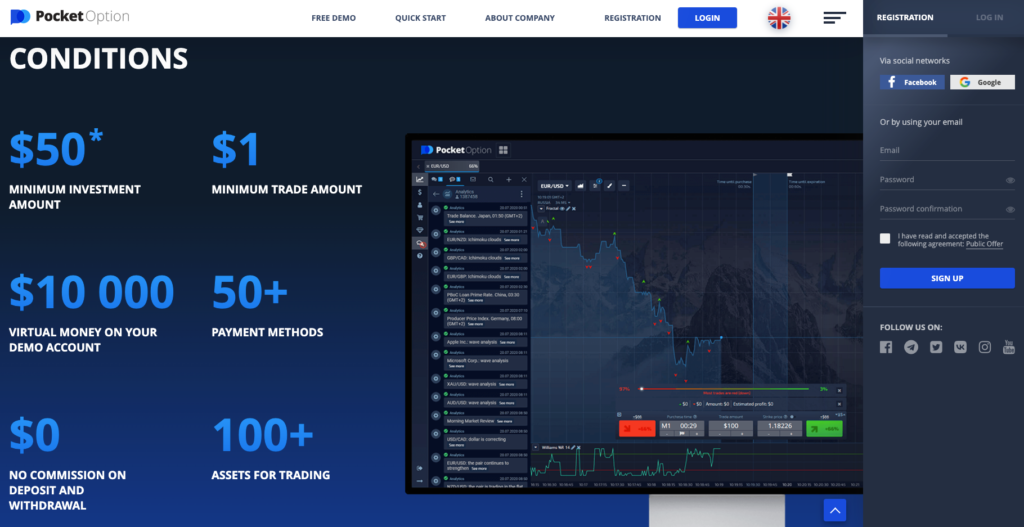

Offshore brokers are a go-to for traders who want more than Nadex offers. These platforms aren’t CFTC-regulated, but many follow rules from places like Cyprus (CySEC), Malta, or even smaller jurisdictions like the Seychelles. Names like Pocket Option, Quotex, and BinaryCent have carved out a niche for US clients. They offer higher payouts—sometimes 80-95%—and a wider range of assets, from forex to crypto. The downside? Regulation isn’t as ironclad as Nadex, so you’re taking a chance. I’ve seen traders do well with these brokers, but I’ve also heard horror stories about withdrawals getting stuck. Always check a broker’s license, read user feedback on sites like Trustpilot, and start with a small deposit to test their reliability.

Here’s how some top offshore brokers stack up:

| Broker | Regulation | Min. Deposit | Payout Range | Assets Available |

| Pocket Option | IFMRRC (Russia-based) | $50 | 80-95% | Forex, crypto, stocks |

| Quotex | None (reputable) | $10 | 70-90% | Forex, commodities |

| BinaryCent | None (established) | $250 | 75-85% | Forex, crypto, indices |

Don’t just pick the one with the highest payout—reliability matters more than a few extra percent.

US-Friendly Payment Methods

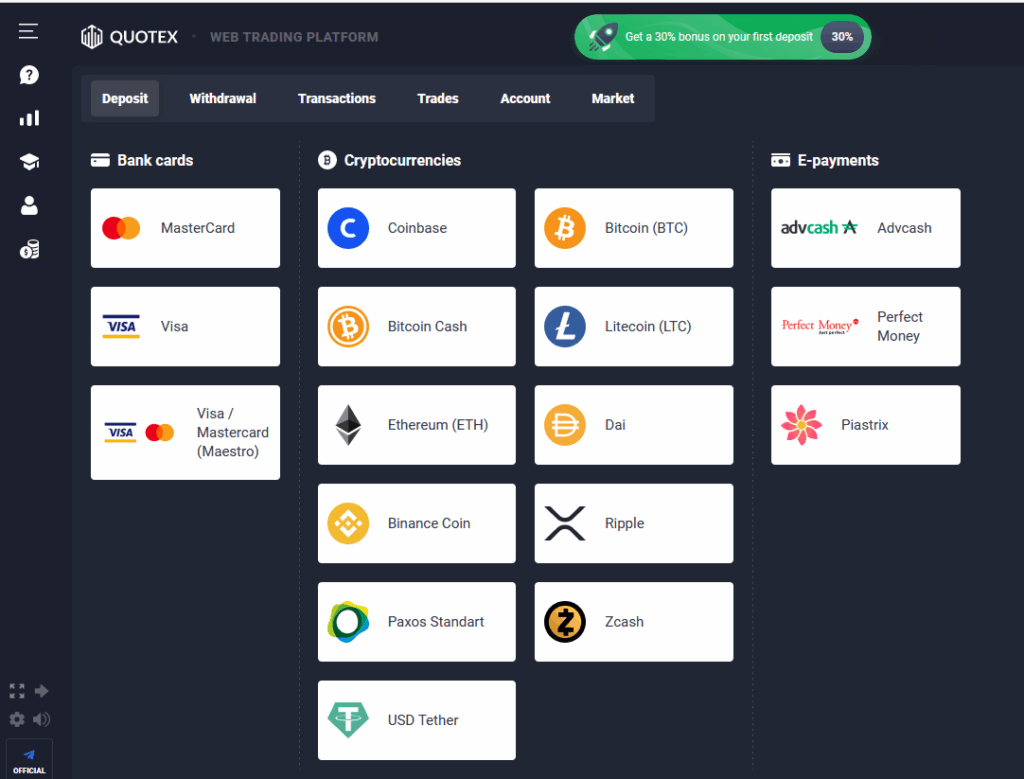

Getting money in and out of your trading account can be a nightmare for Americans. US banks and payment processors are picky, and many brokers don’t bother figuring it out. The best platforms make it painless, offering options that actually work. Cryptocurrencies like Bitcoin, Ethereum, and USDT are a godsend—fast, private, and rarely blocked. E-wallets like Skrill or Neteller pop up occasionally, though they’re less common. Bank cards (Visa or Mastercard) are hit-or-miss due to restrictions, and wire transfers, while secure, can take ages. My tip? Use crypto for speed, but always check the broker’s deposit fees and withdrawal limits before committing.

Verification Requirements for US Clients

Verification is a hassle, but it’s the price of trading with legit brokers. US traders face extra scrutiny because of strict banking laws. Expect to upload a government ID (passport or driver’s license), a recent utility bill, and sometimes a photo of your card (with numbers partially hidden). Offshore brokers might ask for less, but that’s a red flag—proper Know Your Customer (KYC) checks are a sign of trustworthiness. The process usually takes 1-3 days, though some platforms drag it out. Get your documents ready upfront to avoid delays when you’re ready to withdraw. If a broker skips verification entirely, run—they’re likely dodging more than just paperwork.

Offshore Binary Brokers for US Traders

Offshore brokers are a lifeline when you’re stuck with limited US options. They offer more assets, higher payouts, and looser rules than CFTC-regulated platforms like Nadex. In 2025, Pocket Option, Quotex, and BinaryCent lead the pack for Americans. Pocket Option, for instance, has a slick platform and starts at just $50, while BinaryCent caters to crypto fans. These brokers aren’t perfect—regulation can be spotty, and withdrawals aren’t always guaranteed. But they give you flexibility Nadex can’t match, like trading crypto pairs or exotic indices. The golden rule? Start small, test withdrawals early, and never trade with rent money. Check user reviews on Reddit or trading forums to spot red flags before you deposit.

Why traders choose offshore brokers:

- Higher payouts: Often 80-95% vs. Nadex’s 60-80%.

- More assets: Trade forex, crypto, even rare commodities.

- Low barriers: Minimum deposits as low as $10-$50.

Just don’t get cocky—offshore trading is riskier, so keep your wits about you.

Trading Features Important for US Clients

A broker’s only as good as the features they offer. For US traders, it’s about banking, speed, support, and mobility. The right platform saves you headaches and lets you focus on trading. Here’s what to demand in 2025.

US-Friendly Banking Options

Banking is make-or-break. You need deposits to hit instantly and withdrawals to land without a fight. Crypto is the MVP—Bitcoin, Ethereum, or USDT clear fast and dodge bank restrictions. Cards like Visa or Mastercard work sometimes, but declines are common, especially with offshore brokers. E-wallets (Skrill, Neteller) are rare but handy when available. Wire transfers? They’re safe but sluggish, often taking a week. I’ve seen traders get burned by hidden fees, so read the broker’s terms. Deposit a small amount first to test the system, and always track exchange rates if you’re using crypto.

Popular banking methods:

- Crypto: Bitcoin, Ethereum, USDT—fastest and most reliable.

- Cards: Visa/Mastercard, but check for restrictions.

- E-wallets: Skrill or Neteller, less common but quick.

- Bank wires: Secure for large sums, but expect delays.

Fast Withdrawal Processing

Nothing kills the vibe like waiting weeks for your profits. Top brokers process withdrawals in 24-48 hours, especially for crypto. Bank wires can stretch to 5-7 days, which is standard but annoying. Some platforms hit you with fees for “express” payouts—$10 here, $25 there—so check their policy. User reviews are your friend; if traders are complaining about delayed withdrawals, steer clear. Quotex, for example, gets praise for quick crypto payouts, while others lag. Always request a small withdrawal early to test the waters.

Withdrawal speeds compared:

| Method | Typical Processing Time | Common Fees |

| Bitcoin | 24-48 hours | $0-$10 |

| Bank Wire | 5-7 business days | $25-$50 |

| E-wallets | 1-3 days | Varies by platform |

Customer Support in US Time Zones

Good support can save your bacon when trades go sideways. You need a broker with 24/7 help that actually gets US time zones. Live chat is ideal—fast and direct. Phone support is great but rare. Email-only brokers? Pass—they’re too slow for urgent issues. I’ve had clutch moments where Pocket Option’s chat fixed a deposit glitch at 3 a.m. EST. Test support before you trade: fire off a question and see how quick they reply. If they ghost you, move on.

Support features to prioritize:

- Live chat: Instant help, available round-the-clock.

- US hours: Staff who aren’t asleep during EST trading times.

- Multiple channels: Chat, phone, or email for flexibility.

Mobile Trading for US Traders

Trading isn’t just for desks anymore—you need a platform that moves with you. A killer mobile app lets you check charts, place trades, or cash out from anywhere. Look for apps that run smoothly on iOS and Android, with real-time data and no freezes. Features like one-tap trades, customizable alerts, and clean layouts make a difference. Quotex’s app, for instance, is a favorite for its speed and charting tools, perfect for sneaking in trades during a break. Download the app and demo it before funding your account—laggy apps kill momentum.

Binary Options Alternatives for US Traders

Binary options aren’t the only way to chase profits. If CFTC rules feel like a straitjacket, other markets offer similar action with more room to maneuver. From forex to stock options, here’s what US traders can explore in 2025.

Forex Binary Options

Forex binary options are a sweet spot for currency fans. You predict whether a pair like GBP/USD will hit a certain price by a deadline, just like standard binaries. Nadex runs these, so you’re fully CFTC-compliant. Payouts might top out at 70-80%, lower than offshore brokers, but the tradeoff is safety. You can trade major pairs or exotics, with expiries from minutes to days. It’s a great way to dip into forex without the complexity of full-on currency trading. Just don’t expect massive returns—steady wins the race here.

Digital Options Platforms

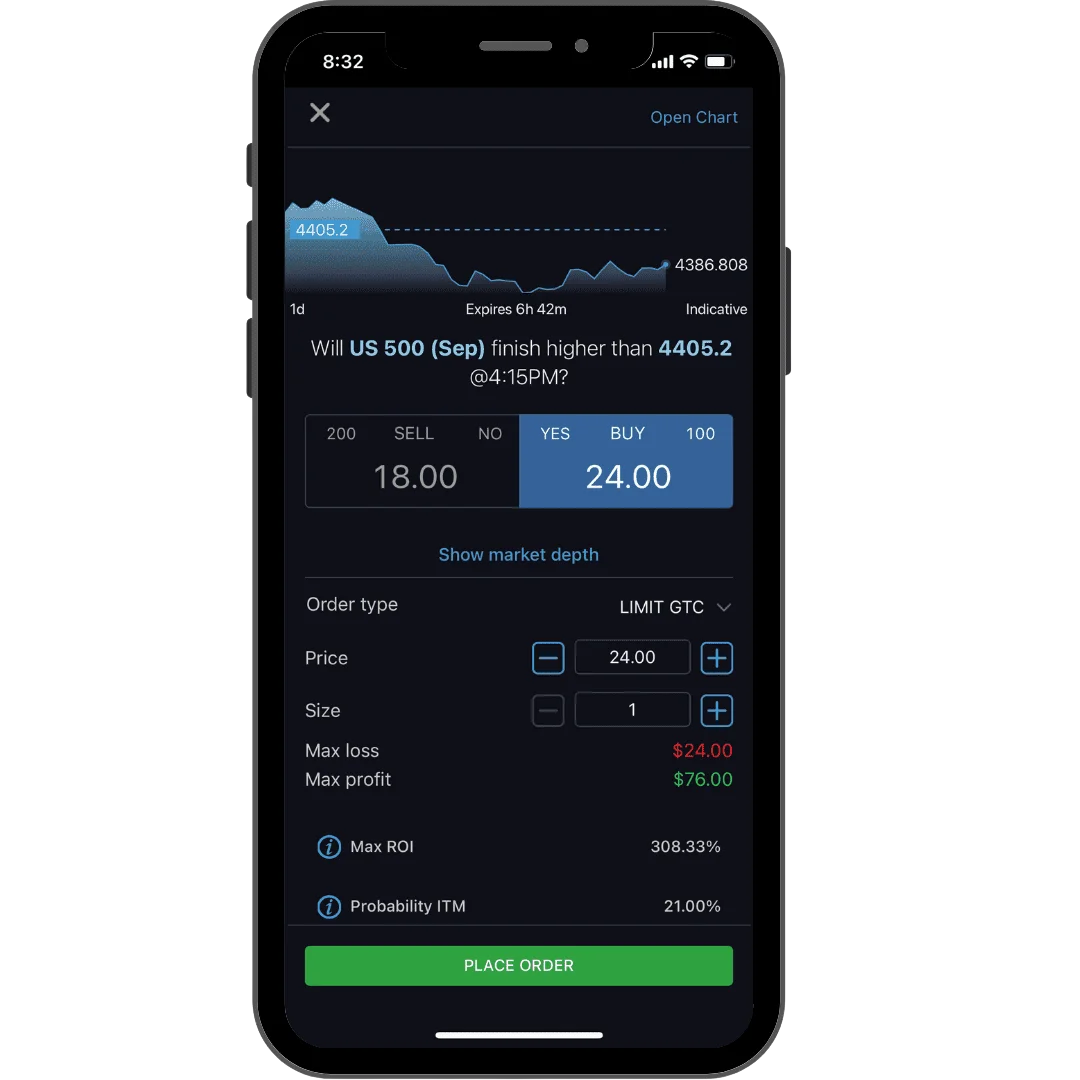

Digital options are like binaries with extra flair. You pick your strike price and can exit trades early, giving you more wiggle room. Offshore brokers like Quotex and Pocket Option offer them, though they’re not CFTC-regulated. That means higher payouts—sometimes 90%—but also higher risks. They’re perfect if you like tweaking your strategy mid-trade, but you need a solid broker. Research their reputation and test with a demo account to avoid getting burned.

Why digital options stand out:

- Flexible strikes: Choose your target price for better odds.

- Early exits: Cash out before expiry to lock in gains or cut losses.

- Wide assets: Trade forex, stocks, or crypto pairs.

CFD Trading as an Alternative

Contracts for Difference (CFDs) let you bet on price moves without buying the asset. Want to trade Tesla stock, Bitcoin, or oil? CFDs cover it all. They’re not binary options, but the leverage and fast trades feel similar. Offshore brokers like Exness or XM offer CFDs to Americans, with leverage up to 100:1 in some cases. That’s a double-edged sword—leverage amps up profits but can wipe you out just as fast. Start with a demo, keep your positions small, and always set stop-losses.

Popular CFD markets:

- Stocks: Apple, Amazon, or trending names.

- Crypto: Bitcoin, Ethereum, or altcoins.

- Commodities: Gold, oil, or natural gas.

- Indices: S&P 500, Nasdaq for broader bets.

Options Trading with US Brokers

Traditional options trading is a powerhouse in the US. You’re buying calls or puts on stocks, ETFs, or indices through brokers like Interactive Brokers or Schwab. It’s not as simple as clicking “up” or “down” like binaries, but it’s way more versatile. You can hedge, speculate, or build complex strategies. Fully regulated and widely available, it’s a natural next step for traders who want more control. Spend time learning—YouTube tutorials or broker webinars are a good start.

State-Specific Binary Options Regulations

Trading binary options in the US isn’t uniform. State laws can make or break your plans. Here’s what you need to know.

Restricted States vs. Open States

Some states clamp down hard on binary options. They’re worried about fraud and want to shield investors. Others are more relaxed. Here’s a quick breakdown:

- Restricted States: New York, Texas, and Illinois often block or limit binary options. You might face bans or heavy oversight here.

- Open States: California, Florida, and Nevada tend to be easier. You can access more platforms, but federal rules still apply.

Check your state’s financial regulator website. A 10-minute search can save you from legal trouble. Don’t assume you’re clear just because a neighbor is trading.

State-Level Regulatory Differences

Rules vary wildly from one state to another. Some states follow federal guidelines closely. Others add their own twists. For example, California might let you trade with certain offshore brokers, while New Jersey could block them. Licensing requirements differ too. In some places, brokers need state approval on top of federal nods. Enforcement also changes. Some states crack down hard on illegal platforms, while others are more hands-off. Know where you stand. If you’re in a tough state, you might need to look at alternatives or stick to regulated markets.

Compliance Requirements by Region

Staying legal means jumping through hoops. Each region has its own checklist. Here’s what you might face:

- Registration: Some states require you to register as a trader or investor.

- Disclosures: Brokers might need to provide extra details about risks and fees.

- Audits: Restricted states could audit your activity more often.

To make it clearer, here’s a table showing examples:

| Region | Compliance Requirement | Frequency/Detail |

| New York (Restricted) | State registration and quarterly reports | Quarterly, detailed |

| California (Open) | Federal CFTC compliance only | Annual, basic |

| Texas (Restricted) | Broker licensing and trader disclosure | Ongoing, strict |

Keep records of everything. Laws change, so check back every few months. It’s a pain, but it keeps you in the clear.

US Trader Protection and Security Measures

Safety matters when you’re trading. US traders need solid protection. Look for brokers with strong security. Encryption is a must—your data and funds should be locked down tight. Check if they’re regulated by trusted bodies, even if they’re offshore. A good broker offers two-factor authentication and secure payment gateways. Watch out for red flags like unclear policies or pressure to deposit more. Read reviews from other traders. If something feels off, trust your gut and move on.

Tax Implications for US Binary Options Traders

Taxes can eat into your profits if you’re not careful. Binary options gains are taxable in the US. Here’s the deal.

You’ll report profits as capital gains or income. Short-term trades (under a year) get hit with your regular income tax rate. Long-term holds might qualify for lower rates. Losses can offset gains, which is a big help.

Here’s a simple list to stay on top of it:

- Track every trade—wins, losses, fees.

- Use brokerage statements for accuracy.

- File Form 8949 and Schedule D with your tax return.

- Consider a tax pro if you’re trading big.

For a quick reference, check this table:

| Trade Type | Tax Treatment | Form to Use |

| Short-Term (under 1 year) | Ordinary income tax rate | Form 8949, Schedule D |

| Long-Term (over 1 year) | Lower capital gains rate | Form 8949, Schedule D |

| Losses | Offset gains, carry forward | Form 8949 |

Don’t guess. Get advice. The IRS doesn’t mess around.

Frequently Asked Questions

Here’s what traders often want to know. I’ll keep it straight and simple.

Is binary options trading legal in the United States?

No, not really. Binary options trading is heavily restricted in the US. The CFTC and SEC say most binary options are speculative and risky. Only a few regulated exchanges, like Nadex, are allowed. Offshore brokers? They’re mostly off-limits for US residents. Check your state laws too—they might add more restrictions.