- Why Trading with Regulated Binary Options Brokers Matters

- Top Regulated Binary Options Brokers for 2025

- Major Regulatory Bodies for Binary Options

- How to Verify a Binary Options Broker’s Regulation

- Trading Features of Top Regulated Brokers

- Regulated vs. Offshore Binary Options Platforms

- Regional Regulations for Binary Options Trading

- The Cost of Regulation – How it Impacts Traders

- Finding the Right Regulated Binary Options Broker

- Frequently Asked Questions

Why Trading with Regulated Binary Options Brokers Matters

Trading binary options isn’t just about picking winners—it’s about staying safe. Regulated brokers follow strict rules set by financial authorities. This means your money is better protected, and you’re less likely to get scammed. I’ve seen traders lose big because they went with shady platforms. Regulation isn’t perfect, but it’s a solid shield against fraud.

A regulated broker has to keep your funds separate from their own. If they mess up, you’ve got a better shot at getting your cash back. Plus, they’re audited regularly, so shady practices don’t slip through easily. Unregulated platforms? They’re a gamble. You might win short-term, but long-term, it’s risky. Regulation also forces brokers to be upfront about fees and risks, so you’re not blindsided.

For me, peace of mind is huge. Knowing there’s a watchdog looking out for my interests lets me focus on trading, not worrying about whether my broker’s legit.

Top Regulated Binary Options Brokers for 2025

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| No fees | CFDs (Forex 100+ pairs, Cryptos, Commodities, Indices, Stocks) | $10 | Up to 1:2000 | MT4 MT5 Exness Terminal Exness Trade App | ||

| No trading/deposit/withdrawal fees | Currency pairs Commodities Cryptos Indices (43 total) | $10 | Not available | Proprietary browser platform Android app | ||

| Spread: 1.7-1.9 points; Withdrawal: 2% | CFDs (Stocks, ETFs, Commodities, Indices, Cryptos, Forex, Options) | $10 | Up to 1:500 (Forex) | IQ Option proprietary Mobile | ||

| No trading fees | MT5: Forex, CFDs (stocks, indices, cryptos, commodities, ETFs) Deriv Trader: Multiplier options | $5-$25 | Up to 1:30 (Forex), 1:150 (stocks CFDs), 1:2 (cryptos) | MetaTrader5 Deriv Trader | ||

| No commission | Currency pairs Commodities Cryptos OTC | $5 | 1:10 to 1:1000 (MT5 Forex, deposits >$1,000) | MT5 Proprietary web Mobile |

Quotex: CySEC-Regulated Trading Experience

Quotex has carved out a solid spot for itself. It’s regulated by CySEC, which means it meets tough European standards. I like their platform because it’s fast and simple—perfect for quick trades. They offer over 400 assets, from forex to crypto, with payouts up to 95%. Their demo account is a great way to test strategies without risking a dime.

What stands out? Quotex keeps things transparent. No hidden fees, and withdrawals are processed fast, often within a day. Beginners will find their mobile app handy, while pros appreciate the charting tools. Just be aware—CySEC’s rules mean leverage is capped, which might limit some high-risk strategies.

IQ Option: Multi-Jurisdiction Compliance

IQ Option is a heavyweight in the trading world. With over 50 million users, they’re doing something right. They’re regulated by CySEC and other bodies, ensuring compliance across regions. Their platform is slick, offering binaries, forex, and even stocks. Payouts can hit 95%, and the $10 minimum deposit makes it accessible.

I’ve always liked their educational resources—videos, webinars, you name it. They’re great for sharpening your skills. Withdrawals are reliable, though you’ll need to verify your ID first, which is standard. One downside? They don’t accept traders from some countries, so check if you’re eligible.

Deriv: Globally Regulated Binary Platform

Deriv, the evolution of Binary.com, brings decades of experience. They’re regulated by multiple bodies, including Malta’s MFSA and the UK’s FCA. This makes them a go-to for traders worldwide. Their platforms—DTrader, DBot, and more—cater to all levels. You can trade forex, indices, or even synthetic assets with payouts up to 90%.

Their $5 minimum deposit is a big draw for newbies. I find their automated trading tools, like DBot, super useful for setting up strategies on autopilot. One catch: their interface can feel overwhelming at first, but you’ll get the hang of it with practice.

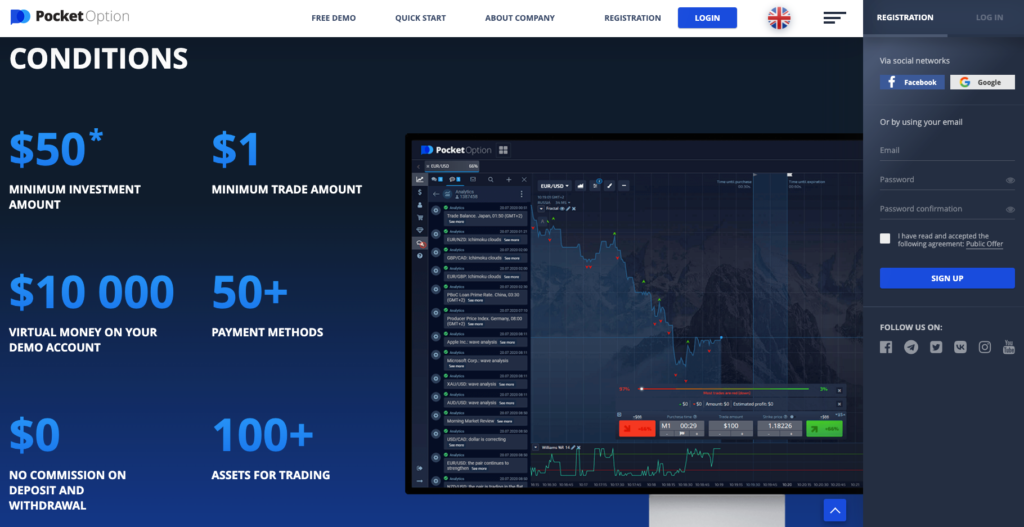

Pocket Option: Emerging Regulated Broker

Pocket Option is newer but gaining traction fast. Regulated by the IFMRRC, it’s not as strict as CySEC or FCA, but it’s still a step above unregulated platforms. They offer 100+ assets and payouts as high as 96%. Their social trading feature lets you copy top traders, which is a game-changer for beginners.

The platform’s intuitive, and I’ve heard traders rave about their bonuses—though read the fine print before jumping in. Withdrawals can take a couple of days, so plan ahead. Pocket Option’s a solid pick if you want flexibility and a fresh vibe.

Exness: Trusted Forex and CFD Broker with Regulation

Exness is a powerhouse in forex and CFD trading, regulated by top-tier authorities like the FCA, CySEC, and South Africa’s FSCA. While they don’t specialize in binary options, their robust platform and tight spreads make them a strong choice for traders exploring diverse markets. They offer forex, metals, and crypto with leverage up to 1:2000 for professionals, though retail traders face stricter caps.

What’s great? Exness boasts lightning-fast withdrawals—often within hours—and a $10 minimum deposit for their Standard account. Their MT4 and MT5 platforms are packed with tools for technical analysis, ideal for experienced traders. Beginners might find the interface complex, but their 24/7 support helps smooth the learning curve. If you’re mixing binaries with other trading, Exness adds serious versatility.

Major Regulatory Bodies for Binary Options

Regulation is only as good as the authority behind it. Four big players—CySEC, FCA, ASIC, and FSCA—set the standard for binary options brokers in 2025. Each has its own rules, but they all aim to protect traders like you and me.

CySEC (Cyprus Securities and Exchange Commission)

CySEC, based in Cyprus, is a powerhouse in Europe. They oversee tons of brokers because Cyprus is a hub for financial firms. CySEC demands brokers keep client funds separate and report regularly. They also cap leverage to reduce risk—sometimes a pain, but it keeps things safer. If a broker’s CySEC-regulated, you’ve got a decent level of protection.

FCA (Financial Conduct Authority)

The UK’s FCA is one of the toughest regulators out there. They’re all about transparency and fairness. Brokers under FCA rules face strict audits and must follow clear guidelines on fees and advertising. If something goes wrong, you can complain directly to the FCA. Their standards are high, which is why FCA-regulated brokers are so trusted.

ASIC (Australian Securities and Investments Commission)

ASIC keeps Australia’s financial markets in check. They’re known for cracking down on dodgy brokers. ASIC requires brokers to hold client funds in segregated accounts and maintain enough capital to cover risks. They also push for clear risk warnings, so you know what you’re getting into. Trading with an ASIC-regulated broker feels secure, especially for Aussies.

FSCA (Financial Sector Conduct Authority)

South Africa’s FSCA is gaining respect globally. They focus on protecting retail traders and ensuring brokers play fair. FSCA-regulated brokers need to meet capital requirements and offer transparent pricing. They’re not as famous as the FCA, but they’re making waves for creating a safer trading environment in Africa and beyond.

Here’s a quick comparison of these regulators:

| Regulator | Country | Segregated Funds | Leverage Cap | Complaint Process |

| CySEC | Cyprus | Yes | 1:30 | Yes |

| FCA | UK | Yes | 1:30 | Yes, robust |

| ASIC | Australia | Yes | 1:30 | Yes |

| FSCA | South Africa | Yes | Varies | Yes, growing |

How to Verify a Binary Options Broker’s Regulation

Don’t just take a broker’s word for it—check their credentials. I’ve been burned before, so now I always dig deeper. Here’s how you can confirm a broker’s legit:

- Visit the regulator’s website: Look up the broker’s license number on CySEC, FCA, ASIC, or FSCA’s official site.

- Check registration details: Make sure the broker’s name and parent company match what’s listed.

- Look for red flags: If the license is from an obscure jurisdiction, think twice.

- Contact the regulator: When in doubt, email or call to verify.

- Read trader reviews: Forums and sites like Trustpilot can reveal if others have had issues.

Taking five minutes to do this can save you a fortune. Trust me, it’s worth it.

Trading Features of Top Regulated Brokers

Regulated brokers don’t just keep your money safe—they offer tools to trade smarter. From account protection to fair conditions, here’s what sets the best apart.

Account Protection Measures

Your funds need to stay secure, no question. Top brokers go all out to protect you. Here’s what they do:

- Segregated accounts: Your money’s kept separate from the broker’s, so it’s safe if they go bust.

- Insurance schemes: Some offer coverage up to a certain amount, like CySEC’s €20,000 fund.

- Two-factor authentication: Keeps hackers out of your account.

- Regular audits: Ensures the broker’s following the rules.

I sleep better knowing my cash isn’t mixed up with the broker’s operating funds.

Transparent Fee Structures

Nobody likes surprise charges. Regulated brokers lay it all out—spreads, withdrawal fees, everything. For example, IQ Option and Quotex show costs upfront on their platforms. Deriv’s spreads are tight, starting at 0.5 pips on some pairs. Pocket Option might charge a small withdrawal fee, but they’re clear about it. Always check the fee page before signing up; it saves headaches later.

Fair Trading Conditions

Fairness is non-negotiable. Regulated brokers ensure trades execute at real market prices—no funny business like price manipulation. Quotex and Deriv offer fast execution, so you’re not stuck waiting. IQ Option’s platform lets you set precise entry points, and Pocket Option’s social trading keeps things competitive. You’ll also get clear expiry times and payout rates, so you know exactly what’s at stake.

Dispute Resolution Processes

If something goes wrong, you need a way to fix it. Regulated brokers have clear steps for handling complaints. Here’s how they do it:

- Dedicated support: Contact via email, chat, or phone—usually 24/7.

- Escalation to regulators: If the broker doesn’t resolve it, you can go to CySEC, FCA, etc.

- Ombudsman services: Some regions offer independent mediators.

- Transparent policies: Rules for disputes are listed on their site.

I’ve had to raise a dispute once, and the broker sorted it fast because they knew the regulator was watching. That’s the power of regulation.

Regulated vs. Offshore Binary Options Platforms

When choosing a broker, the debate between regulated and offshore platforms comes up fast. Regulated brokers follow strict rules from financial authorities, which gives you a safety net. Offshore brokers? They operate in looser jurisdictions, often with fewer checks. I’ve traded both, and while offshore platforms can seem tempting, the risks are real.

Regulated brokers keep your funds in segregated accounts, meaning your money’s not mixed with theirs. If they go under, you’ve got a better chance of getting it back. Offshore brokers might promise higher payouts or bonuses, but there’s a catch—little oversight means they can vanish with your cash. I’ve heard stories of traders waiting months for withdrawals that never came.

That said, offshore platforms sometimes offer more flexibility, like higher leverage or no KYC hassle. But flexibility comes at a cost. Without regulation, there’s no one to complain to if things go south. Regulated brokers, while stricter, give you peace of mind and a clear process for disputes. For me, that’s worth more than a flashy bonus.

Here’s a breakdown to compare the two:

| Feature | Regulated Brokers | Offshore Brokers |

| Fund Protection | Segregated accounts, insured up to €20,000 (e.g., CySEC) | Often no segregation, high risk of loss |

| Leverage | Capped (e.g., 1:30 in EU) | Often unlimited (1:500 or more) |

| Payouts | 80-95% | 85-100% (but less reliable) |

| Withdrawal Time | 1-3 days, verified | Varies, delays common (days to months) |

| Dispute Resolution | Regulator-backed, clear process | None or limited, no oversight |

| KYC Requirements | Mandatory, strict | Often optional or minimal |

Regional Regulations for Binary Options Trading

Rules for binary options vary by region, and knowing them helps you pick the right broker. Each area has its own approach, shaped by local laws and trader needs. Let’s break down the key regions.

European Regulatory Framework

Europe’s a tough place for binary options, and that’s not a bad thing. The European Securities and Markets Authority (ESMA) sets the tone, but national regulators like CySEC take the lead. Since 2018, ESMA banned retail binary options trading in the EU, though some brokers still offer them under strict conditions. CySEC-regulated brokers, for example, serve non-EU clients with leverage caps at 1:30 and mandatory risk warnings.

The focus is on transparency. Brokers must disclose fees, payouts, and risks upfront. They also face regular audits, so shady practices get caught fast. If you’re trading in Europe, you’re dealing with some of the tightest rules around, which means better protection but fewer choices.

UK Binary Options Regulations

The UK’s Financial Conduct Authority (FCA) doesn’t mess around. After ESMA’s ban, the FCA made it permanent for retail traders in 2019, citing high risks. Binary options are mostly limited to professional traders now, who need to prove experience or wealth. FCA-regulated brokers still offer binaries outside the UK, following strict guidelines.

What’s great about the FCA? They demand segregated funds and clear fee structures. If a broker screws up, you can escalate complaints to the Financial Ombudsman Service. It’s a robust system, but it makes trading binaries in the UK tricky unless you’re a pro.

Australian Regulatory Environment

Australia’s ASIC keeps things trader-friendly yet strict. Binary options are legal, but brokers need an Australian Financial Services License. ASIC enforces segregated accounts and caps leverage at 1:30 for retail traders. They’re also big on transparency—brokers must show real-time pricing and avoid misleading ads.

I like ASIC’s balance. You get access to binaries without the wild risks of offshore platforms. Plus, their complaint process is straightforward, so you’re not left hanging if something goes wrong.

Asian Regulatory Landscape

Asia’s a mixed bag. Countries like Japan and Singapore have tight rules, while others, like Malaysia, are looser. Japan’s Financial Services Agency (FSA) regulates binaries heavily, requiring brokers to register and offer fixed payouts. Singapore’s MAS is strict too, focusing on client fund protection. But in places like India or Thailand, regulation’s patchy, so offshore brokers dominate.

This patchwork means you need to be careful. Stick to brokers regulated by reputable bodies, even if they’re not local. It’s the safest way to trade in Asia’s diverse market.

The Cost of Regulation – How it Impacts Traders

Regulation keeps you safe, but it’s not free. It comes with limits that can shape your trading. From leverage caps to paperwork, here’s how it affects you.

Leverage Limitations

Regulators love capping leverage to reduce risk. It’s a double-edged sword. Lower leverage means you’re less likely to blow your account, but it also limits your profits. In the EU, CySEC and ESMA cap it at 1:30 for forex pairs and even lower for binaries. ASIC and the FCA follow similar rules. Meanwhile, offshore brokers might offer 1:500, tempting you to overtrade.

I’ve seen traders chase high leverage and lose big. Capped leverage forces discipline, which isn’t a bad thing. But if you’re experienced, it can feel restrictive. Here’s how it looks across regulators:

| Regulator | Leverage Cap (Retail) | Leverage Cap (Professional) |

| CySEC | 1:30 | Up to 1:100 |

| FCA | 1:30 | Up to 1:200 |

| ASIC | 1:30 | Up to 1:100 |

| FSCA | Varies, often 1:100 | Up to 1:400 |

Bonus Restrictions

Bonuses used to be a big draw—deposit $100, get $50 free. Regulators like CySEC and the FCA cracked down, banning them outright in many cases. Why? Brokers often tied bonuses to crazy trading volume requirements, trapping traders. Now, regulated brokers focus on fair terms instead of flashy promotions.

It’s a bummer if you liked extra cash, but I prefer it this way. No strings attached means you’re trading your money, not chasing impossible goals. Offshore brokers still dangle bonuses, but read the fine print—they’re rarely worth it.

KYC and Documentation Requirements

Know Your Customer (KYC) is non-negotiable with regulated brokers. They need to verify who you are to prevent fraud and money laundering. It’s a hassle, but it’s there for a reason. Here’s what you’ll typically need:

- ID proof: Passport, driver’s license, or national ID.

- Address proof: Utility bill or bank statement, no older than three months.

- Payment verification: Credit card scan or e-wallet screenshot.

- Selfie or video: Some brokers ask for a quick snap to confirm it’s you.

I’ve done KYC a dozen times, and it’s usually quick—takes a day or two. Offshore brokers might skip this, but that’s a red flag. If they don’t care who you are, they might not care about your money either.

Finding the Right Regulated Binary Options Broker

Picking a broker isn’t just about regulation—it’s about what fits your style. You want a platform that’s safe, sure, but also one that works for your goals. Take your time and dig into the details.

Questions to Ask Before Opening an Account

Before you sign up, get answers to these:

- Is the broker regulated, and by whom? Check the regulator’s website to confirm.

- What’s the minimum deposit? Make sure it fits your budget.

- Are fees clear? Look for spreads, withdrawal costs, or inactivity charges.

- What assets can you trade? Forex, stocks, crypto—know your options.

- How fast are withdrawals? Days are okay; weeks are a problem.

- Is there a demo account? Test the platform without risking cash.

- What’s the payout range? 80-95% is standard for regulated brokers.

- Do they offer support? Live chat or email should be responsive.

I always demo a platform first. It’s the easiest way to see if it clicks without betting real money.

Frequently Asked Questions

How long can I use a binary options demo account?

Most brokers offer different demo account durations with some providing unlimited access while others limit usage to 30-90 days. Some platforms reset demo balances periodically, and premium accounts sometimes include permanent demo access. If your demo expires, many brokers will extend it upon request, especially if you’re considering opening a funded account, so don’t hesitate to ask customer service about extensions.