- Why Use a Binary Options Demo Account?

- Best Binary Options Platforms with Unlimited Demo Accounts

- Demo Accounts with No Registration Required

- Time-Limited Binary Options Demo Accounts

- Demo Account Features to Look For

- Realistic Demo Trading vs. Real Money Trading

- From Demo to Live: Making the Transition

- Demo Account Trading Strategies for Beginners

- Advanced Use of Binary Options Demo Accounts

- Frequently Asked Questions

Why Use a Binary Options Demo Account?

Demo accounts saved my trading career. When I first started, I was clueless. I jumped straight into live trading and lost $500 in two days. Big mistake. If I had used a demo first, I would have kept that money.

Here’s why every trader needs a demo account:

- It’s 100% risk-free. You can make all the mistakes you want without losing a penny.

- You can learn the platform. Each trading site works differently. Demo accounts let you find all the buttons before real money is at stake.

- Testing strategies becomes easy. Got a new trading idea? Try it 50 times on demo first to see if it actually works.

- You’ll practice managing risk. Test different position sizes to find what works for your style.

Last month, I developed a new strategy for trading gold during the New York session. Before risking my money, I ran 75 test trades on my demo account. The strategy only had a 48% win rate – not good enough. This testing saved me from certain losses.

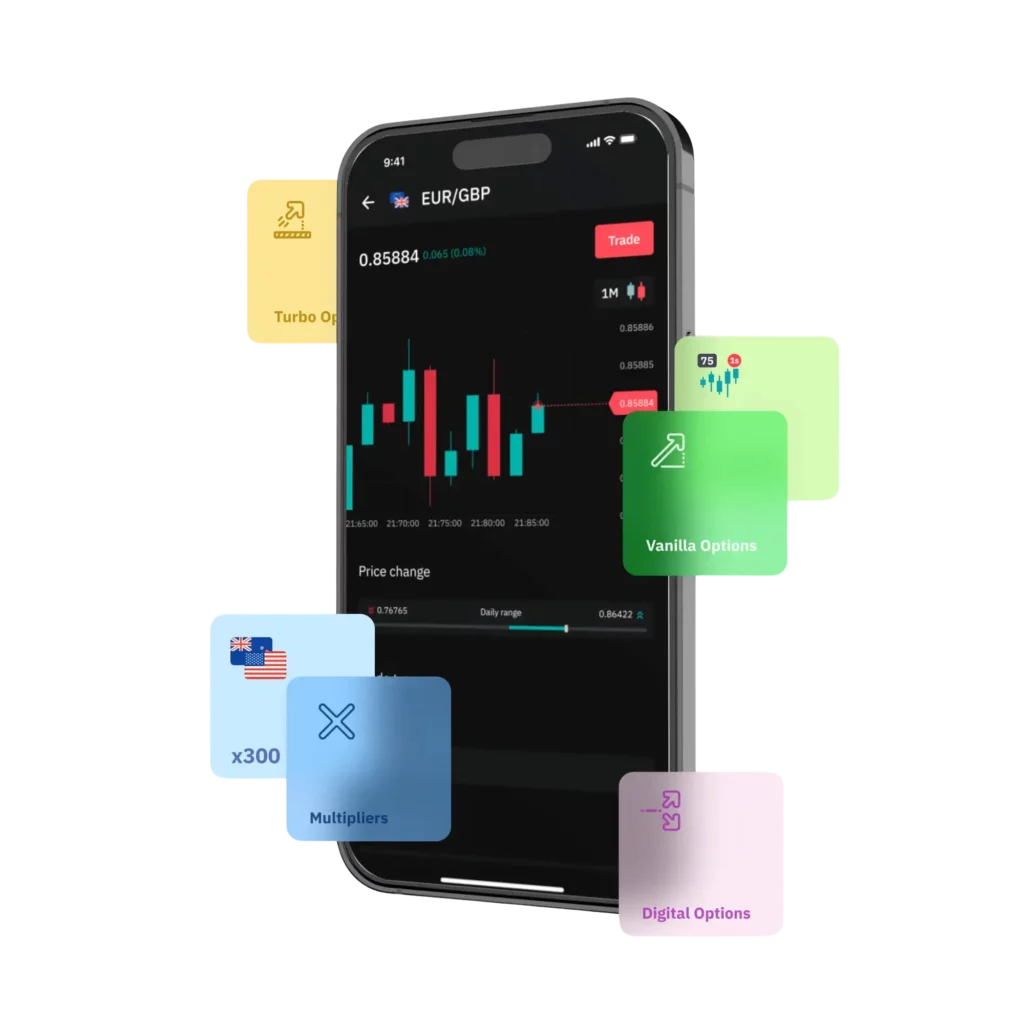

Best Binary Options Platforms with Unlimited Demo Accounts

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| No fees | CFDs (Forex 100+ pairs, Cryptos, Commodities, Indices, Stocks) | $10 | Up to 1:2000 | MT4 MT5 Exness Terminal Exness Trade App | ||

| Spread: 1.7-1.9 points; Withdrawal: 2% | CFDs (Stocks, ETFs, Commodities, Indices, Cryptos, Forex, Options) | $10 | Up to 1:500 (Forex) | IQ Option proprietary Mobile | ||

| No trading fees | MT5: Forex, CFDs (stocks, indices, cryptos, commodities, ETFs) Deriv Trader: Multiplier options | $5-$25 | Up to 1:30 (Forex), 1:150 (stocks CFDs), 1:2 (cryptos) | MetaTrader5 Deriv Trader | ||

| No commission | Currency pairs Commodities Cryptos OTC | $5 | 1:10 to 1:1000 (MT5 Forex, deposits >$1,000) | MT5 Proprietary web Mobile | ||

| No trading commission | Binary options Stocks Indices Metals Commodities ETFs | $10 | Not specified | Webterminal ExpertOption platform Mobile apps (Android, iOS) | ||

| 1% per transaction | Currency pairs CFDs Binary Options | $250 (Bronze); $500 (Silver); $2,500 (Gold); $50,000 (VIP) | Not specified | Webterminal BinaryCent platform Mobile apps (iOS, Android) | ||

| Up to 15% standard trades, 10% FTT | Forex CFDs Stocks Indices Commodities Cryptos ETFs OTC Fixed Time Trades | $10 | Varies by region/market | Olymptrade (web, desktop, mobile) No MT4/cTrader |

No-Expiry Demo Accounts

Some platforms let you keep your demo account forever. These are gold. IQ Option gives you $10,000 in play money that never expires. I’ve had my demo there for over two years. Pocket Option does the same thing, with no pressure to deposit.

The table below shows my favorite unlimited demo platforms:

| Platform | Starting Balance | Expires? | Can Reset? | Extra Notes |

| IQ Option | $10,000 | Never | Yes | Great charts |

| Pocket Option | $10,000 | Never | Yes | No deposit pressure |

| Deriv | $10,000 | Never | Yes | Very accurate |

| ExpertOption | $10,000 | Never | Yes | Easy to use |

I trade on IQ Option most days. Their demo account feels exactly like the real thing. The prices are live, and the platform doesn’t change when you switch to real money.

Replenishable Virtual Funds

Running out of demo money shouldn’t end your practice. Good platforms let you reset your balance. I blow through demo money all the time when testing aggressive strategies.

Olymp Trade automatically tops up your account when you drop below $5,000. This saves time. Quotex gives you a massive $50,000 to start with. When it’s gone, just ask support for more.

Full-Feature Demo Platforms

The best demos don’t hold features back. Deriv lets demo users access all 100+ trading instruments. Nothing is off-limits. IQ Option gives you every technical indicator and drawing tool in demo mode. This matters a lot when you’re developing strategies.

Some platforms cripple their demos. They remove features or limit what you can do. Avoid these. A proper demo should be identical to the real platform in every way except the money.

Demo Accounts with No Registration Required

Instant Access Demo Trading

Sometimes you just want to try a platform without creating an account. Deriv lets you jump right in. No email, no verification, just instant trading. I use these quick-access demos when I’m traveling and want to check a quick trade idea.

Some platforms that offer instant demos:

| Platform | What You Need | Time Limit | Starting Balance |

| Deriv | Nothing | None | $1,000 |

| BinaryCent | Just a username | None | $5,000 |

| IQCent | Nothing | 24 hours | $1,000 |

BinaryCent only asks for a username. It takes 5 seconds to start trading. This is perfect when you’re in a hurry.

Anonymous Demo Accounts

Privacy matters to many traders. Some platforms let you trade completely anonymously. ExpertTrader’s “Guest Mode” gives you $1,000 to play with, no personal details needed.

Quotex doesn’t even use cookies in their demo. This is rare. I use these anonymous demos when testing strategies I don’t want others to know about.

Time-Limited Binary Options Demo Accounts

24-Hour Demo Access

Some platforms offer short-term demos designed for quick platform evaluation. RaceOption provides a 24-hour demo with $500 virtual funds—sufficient time to execute 15-20 trades and get a platform feel.

Binomo’s 24-hour demo comes with market alerts and signals access, giving you a complete preview of their premium features before committing.

In my experience, these short demos are actually enough to evaluate execution speed and basic functionality, though insufficient for proper strategy testing.

Week-Long Demo Trials

Week-long demos provide better strategy testing opportunities. IQCent offers a 7-day demo with $5,000 virtual currency and full platform access.

Pocket Option provides a 5-day trial that includes their signal service—useful for evaluating the quality of their trade alerts before subscribing.

I recently used IQ Option’s 7-day demo to validate a new end-of-day strategy, which required several days of continuous testing to gather meaningful results.

Extended Demo with Conditions

Some platforms offer extended demos with specific conditions. BinaryCent provides a 30-day demo if you verify your email and phone number—a fair trade for longer access.

Olymp Trade extends demo access to 60 days if you complete their basic trading course—a win-win that ensures you have basic knowledge before trading.

Deriv offers unlimited demo extension in 30-day increments if you log in at least once weekly—their way of ensuring engaged users.

| Platform | Demo Duration | Extension Conditions | Virtual Balance | Features Access |

| BinaryCent | 30 days | Email/phone verification | $5,000 | Full |

| Olymp Trade | 60 days | Complete basic course | $10,000 | Full |

| Deriv | 30 days | Weekly login | $10,000 | Full |

| IQ Option | 7 days | None | $5,000 | Full |

| Pocket Option | 5 days | None | $1,000 | Includes signals |

Demo Account Features to Look For

Not all demo accounts are created equal. Look for these key features:

Real market data is essential. Some demos use delayed prices. This is useless for binary options where seconds matter. Once I used a demo with 15-minute delayed quotes. Every trade I made would have failed in real life because the prices were old news.

The trading interface must match the real platform exactly. Some companies give demo users a simplified version of their platform. This defeats the purpose of practice. When you switch to real money, everything looks different. Avoid these platforms.

One day, I spent three hours practicing on a demo platform. When I switched to the real money account, the order screen was completely different. I accidentally bought the wrong option type because the buttons were in different places. A good demo would have prevented this mistake.

Realistic Demo Trading vs. Real Money Trading

The mechanics of demo trading perfectly mirror real trading, but there’s one massive difference: psychology.

When I trade on demo, I can easily stick to my rules. 2% risk per trade? No problem. Wait for confirmation signal? Always. But with real money, everything changes.

Demo trading can’t replicate the emotional impact of watching real profits and losses. It can’t simulate the pit in your stomach when a trade goes against you, or the adrenaline rush from a winning streak that tempts you to increase position size.

Psychological Differences

The stress response is real. Your body literally responds differently to real money trades—heart rate increases, stress hormones release, and decision-making becomes impaired.

Risk perception changes dramatically. On demo, a 10-trade losing streak is a learning experience. With real money, it can trigger panic and revenge trading.

I’ve noticed how discipline wavers with real money. My well-tested 2% risk rule suddenly becomes “just this once I’ll do 5%” when I spot what seems like a perfect setup.

Decision fatigue hits harder with real money. After a few hours of live trading, my ability to stick to rules deteriorates far faster than in demo sessions.

One workaround I’ve found is to “simulate” stakes in demo trading. I set personal consequences for breaking rules—like no trading for 48 hours if I violate my strategy. This adds at least some psychological weight to demo trading.

From Demo to Live: Making the Transition

When You’re Ready for Real Trading

Moving from demo to real money should happen slowly. You’re ready when:

- You’ve been consistently profitable for at least 100 demo trades

- You have clear written rules for your strategy

- You understand your win rate and average profit/loss

- You’ve tested your strategy in different market conditions

Don’t rush this process. Trading isn’t going anywhere. The markets will still be there when you’re ready. I spent six months on demo before trading real money, and I’m glad I did.

Before going live, you should be able to answer these questions easily:

- What percentage of my trades are winners?

- How much do I win on average versus how much I lose?

- Which markets and times work best for my strategy?

- What conditions cause my strategy to fail?

Managing the Psychological Shift

The mental shift to real money trading is challenging. Here’s what worked for me:

Start tiny. Trade the minimum amount possible. Your first goal isn’t to make money – it’s to get comfortable with having real money at risk while still following your rules.

Use this step-up plan:

- First 20 trades: Use 10% of your normal position size

- Next 20 trades: Use 25% of normal size

- Next 20 trades: Use 50% of normal size

- Next 20 trades: Use 75% of normal size

This gradual approach helps your brain adjust to the stress of real trading. I rushed this process once and lost money because I wasn’t emotionally ready for full-size positions.

Set a strict daily loss limit. When starting out, losing more than 3% of your account in a day means you should stop trading and review what happened. Early in my career, I lost 40% in one day because I kept trading after several losses. Don’t make this mistake.

Keep your demo account active even after you start trading real money. Use it to test new ideas before trying them with real cash. I still use demo accounts weekly, even after years of profitable trading.

The psychological adjustment to real money trading takes time. For most traders, it’s 3-6 months before they feel comfortable. During this time, focus on following your process rather than making money. A perfect execution of a losing trade is better than breaking rules on a winning trade.

Demo Account Trading Strategies for Beginners

I lost thousands when I first started trading. I wish I’d used a demo account first. Demo accounts let you practice without losing real money. Use them.

Basic Binary Options Strategy Testing

Demo accounts are perfect for trying out different trading ideas. Start simple.

Try High/Low trades first. Pick an asset and guess if the price will go up or down. That’s it. No fancy tools needed yet.

Test different time settings. I’ve found that 5-minute trades work very differently from 1-hour trades. Each asset has its sweet spot.

Try range trades too. These pay more but they’re trickier. You bet if prices stay inside or break outside a set range.

Technical Analysis Practice

Charts can look like a mess at first. Demo accounts help you make sense of them without losing money.

Start with basic candle patterns. Look for dojis, hammers, and engulfing patterns. I couldn’t spot these until I’d practiced for weeks.

Then try some basic tools. RSI is a good first one to learn. It shows when assets might be overbought or oversold. MACD is good too – it helps spot trend changes.

Support and resistance matter a lot in binary options. Draw lines where prices keep bouncing or breaking through. These are good places to enter trades.

Don’t overload your charts. I made this mistake too. Just pick two tools that work well together – one for trends and one for timing.

Look at different timeframes. Check the bigger picture first, then zoom in for exact entry points. This simple trick made a huge difference in my win rate.

Risk Management Experimentation

Most traders fail because of poor risk management, not bad trade picks. Demo accounts let you test different risk approaches safely.

Never bet more than 1-5% of your account on one trade. I stick to 2% max, even after years of trading. This simple rule has saved me countless times.

Try different position sizes and track what happens. Many new traders are shocked to find they do better with smaller bets. You make clearer decisions when less money is at stake.

Test the Martingale system if you want. It tells you to double your bet after each loss. It seems great until it wipes out your account. I’ve seen it happen many times.

The anti-Martingale often works better: increase size after wins, decrease after losses. This approach turned my trading around after months of struggle.

Trading Journal Implementation

Without a trading journal, you’re just gambling. My trading only became profitable after I started tracking every trade.

Write down the basics: what you traded, which way you bet, when you entered, when it ended, and if you won or lost. Also note market conditions and how you felt before the trade.

I use a simple spreadsheet with these columns:

- Date and time

- Asset

- Trade type

- Entry price

- End time

- Result (win/loss)

- Strategy used

- How I felt

- Notes

Look at your results weekly and monthly. Patterns show up fast. You’ll notice certain moods lead to bad trades. For me, feeling overconfident led to disasters.

Try different journal styles until one sticks. Some traders like paper journals, others use apps. What matters is doing it every day.

Advanced Use of Binary Options Demo Accounts

Once you know the basics, demo accounts become even more useful. They let you test complex methods that can set you apart from average traders.

Automated Strategy Validation

Trading bots have changed binary options, but never trust a bot with real money without testing it first. I learned this lesson the hard way.

Use demo accounts to check any signal service or bot before paying for it. Run the signals alongside your demo account for at least two weeks. Compare what they promised with what actually happened.

Try making your own simple bot if your platform allows it. Even basic automation can show patterns human traders might miss. My first bot just placed trades based on RSI – nothing fancy, but it taught me to be consistent.

For bot testing, track results like this:

| Bot/Signal | Trades Taken | Win Rate | Profit/Loss | Market Type | Notes |

| RSI Bot | 63 | 58% | +$432 | Trending | Poor in ranging markets |

| Signal Service A | 42 | 64% | +$512 | All types | Slow signals |

| Manual Trading | 50 | 61% | +$485 | All types | Takes too much time |

This approach shows strengths and weaknesses that sales pages never mention.

Backtesting Capabilities

Some good demo platforms let you test strategies against past data. This feature is incredibly valuable.

Backtesting shows how your ideas would have worked in the past. I’ve saved thousands by finding out that “unbeatable” strategies failed during market crashes or high volatility.

When backtesting, try small changes to your settings. Sometimes changing an RSI from 14 to 9 periods makes a huge difference. Small tweaks often bring big improvements.

Test your ideas across different market conditions:

- Rising markets

- Falling markets

- Sideways markets

- High volatility periods

- Low volatility periods

- Before/after big economic news

No single strategy works in all conditions. Build a toolkit of approaches for different scenarios.

Performance Metrics Analysis

Demo accounts create data. Smart traders look beyond simple win/loss counts.

Track these important numbers:

- Win rate: What percentage of trades win

- Average win vs. average loss: Are your winners bigger than your losers?

- Maximum drawdown: Biggest drop from peak to bottom

- Profit factor: Total profits divided by total losses

- Expectancy: (Win rate × Average win) – (Loss rate × Average loss)

Focus on expectancy – it shows what you can expect to make per dollar risked. Some strategies with lower win rates actually make more money because when they win, they win big.

I once compared three strategies that all won about 60% of trades. The expectancy calculations showed one was much better in the long run.

Market Correlation Studies

Advanced traders use demo accounts to study how different assets move together. This knowledge opens up smarter trading chances.

Test how currency pairs move together. EUR/USD and GBP/USD often trend similarly. When they don’t, it might signal a good trade.

Watch how oil prices affect certain currencies. Oil changes impact CAD pairs in predictable ways. Gold movements often affect AUD.

Stock markets usually move together too. S&P 500, Dow Jones, and Nasdaq typically rise and fall as a group. When one breaks the pattern, it often signals a bigger market shift coming.

I use a simple chart to track these relationships:

| Asset Pair | Correlation | Notes |

| EUR/USD & GBP/USD | 0.87 | Move together strongly |

| Gold & USD/JPY | -0.65 | Moderate opposite movement |

| Oil & USD/CAD | -0.72 | Strong opposite movement |

| S&P 500 & NASDAQ | 0.93 | Very strong together |

Understanding these connections helps confirm signals or spot early warning signs of market turns.

Frequently Asked Questions

How long can I use a binary options demo account?

Most brokers offer different demo account durations with some providing unlimited access while others limit usage to 30-90 days. Some platforms reset demo balances periodically, and premium accounts sometimes include permanent demo access. If your demo expires, many brokers will extend it upon request, especially if you’re considering opening a funded account, so don’t hesitate to ask customer service about extensions.