- The Advantage of Low Deposit Binary Options Trading

- Best Binary Options Brokers with $5-$10 Minimum Deposits

- Binary Options Platforms with $20-$50 Deposits

- $100 Minimum Deposit Binary Options Sites

- Payment Methods for Low Deposit Trading

- Making the Most of a Small Trading Deposit

- Low Deposit vs. Free Demo Accounts

- Common Restrictions with Low Deposit Accounts

- Bonuses and Promotions for Small Deposits

- Frequently Asked Questions

The Advantage of Low Deposit Binary Options Trading

Low deposit trading is a smart move for anyone wary of big risks. With just $5 or $10, you can get started without draining your savings. It’s perfect for newbies who want to see how prices move or for veterans testing a new broker’s platform. I remember my first $10 deposit years ago—it taught me more about discipline than any demo account ever could.

Why else is it great? It forces you to focus on strategy, not luck. You can’t afford to throw money around, so you learn to analyze charts, pick the right assets, and time your trades. It’s less stressful, too. When you’re not worried about losing hundreds, you can think clearer and make better calls. For example, I once used a $15 deposit to test a scalping strategy on forex pairs, and it worked so well I scaled up later.

Low deposits also offer flexibility. You can try stocks, commodities, or crypto without committing big bucks. Over time, as you gain confidence, you can increase your stake. It’s not just for the cautious—it’s for anyone who wants to grow steadily and smartly.

Best Binary Options Brokers with $5-$10 Minimum Deposits

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| No fees | CFDs (Forex 100+ pairs, Cryptos, Commodities, Indices, Stocks) | $10 | Up to 1:2000 | MT4 MT5 Exness Terminal Exness Trade App | ||

| $2 (Standard), $0 (Gold, VIP) | Currencies Stocks Indices Contracts Commodities Cryptos | $10 | Not specified | Binomo (browser, desktop, Android, iOS) | ||

| No commission | Currency pairs Commodities Cryptos OTC | $5 | 1:10 to 1:1000 (MT5 Forex, deposits >$1,000) | MT5 Proprietary web Mobile | ||

| Spread: 1.7-1.9 points; Withdrawal: 2% | CFDs (Stocks, ETFs, Commodities, Indices, Cryptos, Forex, Options) | $10 | Up to 1:500 (Forex) | IQ Option proprietary Mobile | ||

| Up to 15% standard trades, 10% FTT | Forex CFDs Stocks Indices Commodities Cryptos ETFs OTC Fixed Time Trades | $10 | Varies by region/market | Olymptrade (web, desktop, mobile) No MT4/cTrader | ||

| 1% per transaction | Currency pairs CFDs Binary Options | $250 (Bronze); $500 (Silver); $2,500 (Gold); $50,000 (VIP) | Not specified | Webterminal BinaryCent platform Mobile apps (iOS, Android) |

Platforms Accepting $5 Minimum Deposits

A $5 minimum is the bare minimum, and it’s perfect for testing the waters. These platforms are rare but excellent for beginners or budget-conscious traders. Here’s a detailed list with specifics:

- Deriv: Minimum deposit $5, minimum trade $1, payouts up to 95%. Offers a demo account, 24/7 live chat, and assets like forex, indices, and commodities. I’ve used it to trade EUR/USD with small stakes, and their platform is reliable.

- Binomo: Also $5 minimum, minimum trade $1, payouts up to 90%. Has a mobile app, video tutorials, and fast withdrawals. Watch for a $30 withdrawal minimum, though.

- Pocket Option: Starts at $5, minimum trade $1, payouts up to 98%. Supports e-wallets, cards, and crypto, with a user-friendly interface. Their customer service is top-notch, available 24/7.

With $5, you’re limited to micro-trades, usually $1 to $5 per contract. It’s not for big profits, but it’s a safe way to learn. Check for hidden fees, like inactivity charges after 90 days, and ensure the broker is regulated, like Deriv under the MGA.

$10 Deposit Binary Options Brokers

Stepping up to $10 gives you more breathing room. These brokers offer better features and assets while keeping risk low. Here’s what you’ll find:

- IQ Option: Minimum deposit $10, minimum trade $1, payouts up to 95%. Trades stocks, forex, crypto, and more with a slick platform. Their mobile app is great for on-the-go trading.

- Binomo: Accepts $10, minimum trade $1, payouts up to 92%. Offers fast support, educational resources, and a demo account. I once doubled my $10 deposit in a week trading gold options.

- Olymp Trade: Starts at $10, minimum trade $1, payouts up to 90%. Has 24/7 support, a demo mode, and low fees. They’re regulated by the IFC, so your funds are secure.

- Exness: Minimum deposit $10 (varies by account type), minimum trade $0.01 (lot size for forex/CFDs). While primarily a forex and CFD broker, Exness offers trading on assets like forex pairs and commodities that can complement binary options strategies. Regulated by FSCA, FCA, and CySEC, it’s a trusted choice with a demo account and 24/7 support. Note that binary options aren’t directly offered, but their low deposit makes them worth considering for diversified trading.

With $10, you can spread your risk across 10 trades if each is $1. Look for brokers with low spreads, no hidden fees, and clear withdrawal policies. Regulation by bodies like CySEC or ASIC is a must.

Binary Options Platforms with $20-$50 Deposits

For $20 to $50, you get more trading power and features. These platforms are for traders ready to step up but still want to keep risk manageable.

$20 Minimum Deposit Options

A $20 deposit opens up new possibilities. You can trade more assets and grab bonuses. Here’s a breakdown:

- Pocket Option: Minimum $20, minimum trade $5, payouts up to 98%. Supports e-wallets, cards, and crypto, with fast withdrawals (under 1 hour). Their bonus can add 30% to your deposit.

- Quotex: Also $20 minimum, minimum trade $1, payouts up to 95%. Offers real-time charts, 24/7 support, and no inactivity fees. I’ve used it to trade Bitcoin with good results.

- BinaryCent: Starts at $20, minimum trade $0.10, payouts up to 95%. Focuses on crypto and forex, with bonuses up to 50%. Watch for a 20x turnover requirement on bonuses.

With $20, you can test strategies like day trading or swing trading. Bonuses are tempting, but read the fine print—some require 20-30 trades before you can withdraw profits.

$25-$50 Deposit Range Brokers

For $25 to $50, you’re in serious territory but still low risk. These brokers offer advanced tools for growing traders. Here’s the list:

- RaceOption: Minimum $25, minimum trade $5, payouts up to 95%. Trades forex, stocks, crypto, and more, with fast withdrawals and 24/7 support. Their platform is intuitive for technical analysis.

- Binarium: Starts at $50, minimum trade $1, payouts up to 90%. Offers advanced charts, indicators, and a demo account. Their customer service is responsive, even on weekends.

- ExpertOption: Accepts $50, minimum trade $1, payouts up to 95%. Has 24/7 support, educational videos, and a mobile app. I’ve used it to trade oil futures with decent returns.

With $50, you can afford to lose a few trades while experimenting. These brokers often have higher payouts and better leverage, but check for withdrawal fees, which can range from 1% to 5%.

$100 Minimum Deposit Binary Options Sites

A $100 deposit feels like a bigger commitment, but it’s still low for some traders. These platforms offer premium features for those ready to level up.

Trading Conditions Comparison

Here’s an updated table comparing $100 minimum deposit brokers, with more details to help you choose:

| Broker | Minimum Deposit | Minimum Trade | Max Payout | Key Features | Withdrawal Fee | Regulation |

| Quotex | $100 | $5 | 100% | Fast withdrawals, crypto support | 2% (min $5) | IFSC |

| IQ Option | $100 | $10 | 95% | User-friendly, 24/7 support | 1.5% (min $10) | CySEC |

| Pocket Option | $100 | $5 | 96% | Social trading, tournaments | Free | IFMRRC |

| Exness | $100 | $10 | 92% | Multiple platforms, low spreads | Free | CySEC, FCA |

With $100, you get access to better leverage (up to 1:400 on some), more assets, and faster customer service. But trade sizes increase, so plan your strategy. Compare fees, spreads, and regulation status before committing.

Who Should Consider These Platforms

A $100 deposit is best for traders with some experience. If you’ve mastered $10 or $50 deposits and want more, this is your next step. It’s also ideal for part-time traders or those with a bit more capital but not ready to risk thousands.

For example, if you’ve been trading forex on lower deposits and understand support/resistance levels, $100 brokers like Exness give you access to more contracts and better payouts. IQ Option offers advanced charting tools that benefit experienced traders, while Pocket Option’s social trading features help you learn from others’ strategies. Quotex provides higher payouts for those confident in their predictions. Casual traders might find $100 too much, but serious learners or scalpers will thrive. Just ensure you’re comfortable with higher stakes and have a solid plan.

Payment Methods for Low Deposit Trading

Choosing the right payment method is key for small deposits. Each option has different speeds, fees, and limits. Here’s a comprehensive look.

E-Wallets for Small Deposits

E-wallets are fast and secure for low deposits. Here’s an expanded list with more details:

- Skrill: Minimum deposit $5, no deposit fee, withdrawal fee 1-2% (min $0.50). Instant transfers, accepted by most brokers. I’ve used it for years—super reliable.

- Neteller: Starts at $10, no deposit fee, withdrawal fee 2-5% (min $1). Fast, but check if your broker offers bonuses with it.

- PayPal: Minimum $5 on select brokers, no deposit fee, withdrawal fee 3% (min $2). Less common, but secure and user-friendly.

- WebMoney: Minimum $10, no deposit fee, withdrawal fee 0.8-1.5%. Popular in Europe and Asia, fast processing.

E-wallets are ideal for speed, but some brokers limit bonuses or charge inactivity fees after 6 months. Always confirm terms.

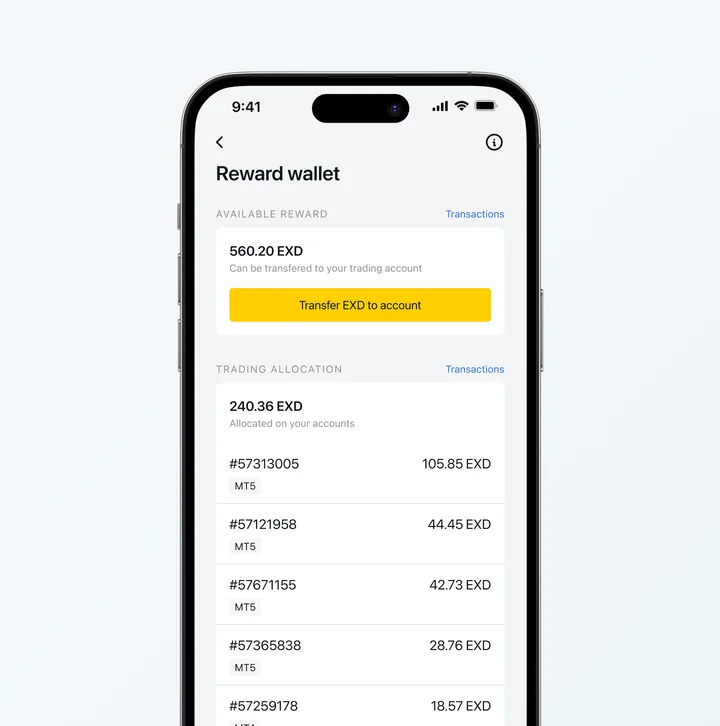

Cryptocurrency Minimum Deposits

Crypto is growing for binary options. Here’s a detailed breakdown:

- Bitcoin: Minimum $10, no bank fees, conversion fee 1-3%, value can swing 5-10% daily. Use it if you’re okay with volatility.

- Ethereum: Starts at $15, transaction fee $0.50-$2, conversion fee 2%, faster than Bitcoin. Good for smaller deposits.

- Litecoin: Minimum $10, fee $0.20-$1, less volatile, but fewer brokers accept it. Stable option for crypto fans.

- Ripple (XRP): Minimum $5 on some platforms, fee $0.01-$0.50, fast and cheap, but check broker support.

Crypto’s great for privacy, but prices can drop fast. Ensure your wallet is ready and check for conversion fees.

Credit/Debit Card Minimum Requirements

Cards are reliable and instant. Here’s an expanded list:

- Visa: Minimum deposit $5, no deposit fee, withdrawal fee 2-8% (min $5). Instant, but watch for regional blocks. Exness accepts Visa with no deposit fees.

- Mastercard: Also $5 minimum, no deposit fee, withdrawal fee 3-7% (min $7). Widely accepted, but some brokers charge extra for AMEX.

- American Express: Starts at $10, no deposit fee, withdrawal fee 5-10% (min $10). Premium, but higher costs.

- Discover: Minimum $10 on some brokers, no deposit fee, withdrawal fee 4-9% (min $8). Less common, but secure.

Cards are easy to use, but withdrawal fees can eat into profits. Confirm your card works globally and check broker policies.

Bank Transfer Options

Bank transfers are secure but slower. Here’s the full scoop:

- Minimum: Usually $50, processing time 1-5 days, bank fee $20-$50, broker fee 1-2%.

- Best For: Larger deposits or traditional traders. Slower, but secure for big amounts.

- Examples: Nadex charges $25 per transfer plus 1% broker fee, World Forex adds 2% (min $10). Exness offers bank transfers with no broker fees for some regions, but bank charges apply. Check cut-off times—some close at 3 PM local time.

Use bank transfers for stability, not speed. Confirm all fees and ensure your bank supports international transfers.

Making the Most of a Small Trading Deposit

Starting with a small deposit, like $5 or $10, doesn’t mean you can’t succeed. You just need to be smart. First, focus on low-risk trades. Stick to assets you understand, like major currency pairs or popular stocks. For example, trading EUR/USD with a $1 stake is a good way to test the waters.

Manage your money carefully. Never risk more than 1-2% of your deposit on a single trade. If you have $10, that’s just 10-20 cents per trade. It sounds tiny, but it adds up. Use simple strategies, like following trends or trading during high-volume hours. I once turned a $20 deposit into $50 in a week by trading gold options during U.S. market hours.

Set realistic goals. Don’t expect to get rich quick. Aim for steady gains, like 10-20% on your deposit. Track every trade in a journal. Note what works and what doesn’t. Over time, you’ll see patterns. Small deposits also force you to learn fast. You can’t afford mistakes, so you get better quickly.

Here’s a quick list of tips:

- Start with low-stake trades ($1-$5).

- Trade during peak market hours for better volatility.

- Use demo accounts to practice new strategies before risking real money.

- Avoid overtrading—stick to 5-10 trades per day.

- Reinvest profits gradually to grow your account.

With discipline, even a small deposit can be a stepping stone to bigger things.

Low Deposit vs. Free Demo Accounts

Choosing between a low deposit and a free demo account can be tricky. Both have their place, but they serve different purposes. Let’s break it down.

When to Use Each Option

Demo accounts are great for beginners. They let you trade with virtual money—no risk, no stress. Use them to learn the platform, test strategies, and get comfortable with charts. For example, if you’re new to binary options, spend a week on a demo like IQ Option’s, which gives you $10,000 in fake funds.

Low deposits, on the other hand, are for when you’re ready to trade live. They teach you real market feel—spreads, fees, and psychology. I recommend starting with a $10 deposit after mastering a demo. It’s a bridge between practice and pro. Use demos for experimenting with risky strategies, like short-term trades, and low deposits for building confidence with real money.

Psychological Differences in Trading

Trading with real money hits different. On a demo, you might take big risks because there’s no consequence. But with a $5 deposit, every trade feels heavier. You second-guess yourself more. That’s not bad—it builds caution. I’ve seen traders lose thousands on demos but panic with just $10 live. It’s normal.

Real money trading also feels more rewarding. When you make $2 profit on a $1 trade, it’s a rush. Demos can’t replicate that. But the pressure can lead to mistakes, like closing trades too early or overtrading. The key is to stay calm. Treat your small deposit like a learning tool, not a get-rich-quick scheme.

Transitioning from Demo to Real Money

Moving from demo to live trading is a big step. Start small—$5 or $10 is enough. Use the same strategies that worked on the demo, but adjust for fees and spreads. For instance, if your demo strategy relied on tight spreads, check if your live broker charges extra.

Set a goal for your first live trades, like making 5 profitable trades in a row. Track your emotions. Are you nervous? Excited? Note it. I transitioned by starting with $10 on Binomo, using the same trend-following strategy I mastered on their demo. It took a week to feel comfortable, but I learned fast.

Practice risk management from day one. Use stop-losses if available, and never risk more than 2% of your deposit. Over time, as you gain confidence, you can increase your stakes. The transition is about building trust in yourself, not just the market.

Common Restrictions with Low Deposit Accounts

Low deposit accounts come with limits. First, trade sizes are often small. If you deposit $5, you might only trade $1 contracts, which caps your potential profits. Some brokers also restrict withdrawals until you hit a trading volume, like 20x your deposit. For example, with a $10 deposit, you might need to trade $200 worth before cashing out.

Bonuses can be tricky, too. Many low deposit brokers offer matches, but they come with strings attached. You might not access all features, like advanced charts or higher leverage, until you upgrade. Inactivity fees are another catch—some charge after 90 days if you don’t trade.

Here’s a list of common restrictions:

- Minimum trade sizes ($1-$5).

- Withdrawal limits (e.g., 20x trading volume required).

- Limited access to advanced tools or assets.

- Inactivity fees (1-5% after 90 days).

- Bonus restrictions (higher turnover required).

Know these upfront. Read the terms before depositing. If a broker’s rules feel too tight, look elsewhere.

Bonuses and Promotions for Small Deposits

Bonuses can boost your small deposit, but they’re not free money. Let’s look at what’s out there.

Deposit Match Offers

Many brokers offer matches on low deposits. For example, deposit $10, and they might add $5-10 more. Here are some examples:

- Pocket Option: 50% match on $20 deposits, up to $50 extra.

- Binomo: 25% match on $10 deposits, up to $25 extra.

- RaceOption: 100% match on $50 deposits, but max $100 bonus.

- Exness: Occasionally offers deposit bonuses for specific account types (varies by region), typically 10-50% on $50-$100 deposits. Check their promotions page, as bonuses are less common for forex/CFD accounts.

These can double your trading capital, but they’re not instant cash. Use them to test strategies, not to withdraw right away. Check if the bonus applies to your payment method—some exclude e-wallets.

Bonus Terms to Watch For

Bonuses sound great, but the fine print matters. Here’s what to look out for:

- Turnover Requirement: You might need to trade 20x-50x the bonus amount before withdrawing. For a $10 bonus, that could mean $200-$500 in trades.

- Time Limits: Bonuses often expire in 7-30 days. Use them fast or lose them.

- Restricted Assets: Some bonuses only work on certain markets, like forex or crypto.

- Withdrawal Restrictions: You can’t cash out the bonus itself, only profits made with it.

Always read the terms. If a bonus seems too good, it probably is. Focus on brokers with clear rules and fair conditions.

Frequently Asked Questions

How long can I use a binary options demo account?

Most brokers offer different demo account durations with some providing unlimited access while others limit usage to 30-90 days. Some platforms reset demo balances periodically, and premium accounts sometimes include permanent demo access. If your demo expires, many brokers will extend it upon request, especially if you’re considering opening a funded account, so don’t hesitate to ask customer service about extensions.