- Binary Options Trading in South Africa

- Leading Binary Options Platforms for South Africans

- South African Payment Methods for Binary Trading

- Mobile Trading Apps for South African Conditions

- Demo Accounts for South African Traders

- Binary Options Education for South Africans

- Tax Implications for South African Binary Traders

- Low Minimum Deposit Options for South Africans

- R500-R1,000 Deposit Range Platforms

- Frequently Asked Questions

Binary Options Trading in South Africa

Binary options trading is gaining popularity in South Africa. The concept is straightforward: predict whether an asset’s price (such as a JSE-listed stock or the USD/ZAR currency pair) will rise or fall within a specified timeframe. Correct predictions earn a predetermined return, while incorrect ones result in losing your investment. This fast-paced trading style appeals to those seeking quick results, but success requires knowledge, strategy, and a reputable broker.

South African markets offer diverse trading opportunities, including local companies like MTN and Sasol, global currency pairs, and commodities such as gold. Binary options provide access to these markets without requiring asset ownership. However, these investments carry significant risk, as an unsuccessful trade can result in complete loss of your stake. Selecting an appropriate platform is crucial—look for brokers offering South African payment methods, JSE-listed assets, and local customer support.

Why are binaries so popular here? They’re flexible. You can trade with small amounts, even R100. Plus, the quick turnaround fits South Africa’s hustle. But discipline is key. Without a strategy, you’re just guessing. And guessing doesn’t pay the bills.

Why South Africans love binary options:

- Fast results—trades settle in minutes or hours.

- Low entry—start small without big cash.

- Local focus—trade JSE stocks or USD/ZAR.

- No ownership—just predict price moves.

FSCA Regulation and Oversight

The Financial Sector Conduct Authority (FSCA) is South Africa’s financial watchdog. It’s there to keep brokers honest. FSCA-regulated platforms follow strict rules, like keeping your money in separate accounts. That means if the broker goes bust, your funds stay safe. They also face audits, so shady tricks get caught fast. It’s not perfect, but it’s a solid safety net.

Why’s this matter to you? Unregulated brokers can be a disaster. Some vanish with your deposits or slap on hidden fees. An FSCA license shows a broker’s serious—they’re playing by the rules. You can check their license number on the FSCA website in seconds. Don’t fall for flashy ads from unlicensed platforms. Big bonuses often hide bigger risks.

Trading with an FSCA broker feels different. You’re not watching your back every second. Platforms like Exness carry that license, giving you confidence to focus on trades, not tricks. Always verify regulation before signing up—it’s your money on the line.

| FSCA Benefit | Why It Helps You |

| Segregated Accounts | Your cash stays safe if broker fails |

| Transparent Fees | No surprises eating your profits |

| Dispute Resolution | A way to fix issues fairly |

Leading Binary Options Platforms for South Africans

Your broker is your trading lifeline. A good one makes everything click—fast trades, clear charts, quick payouts. A bad one? It’s like driving with a flat tire. South Africa’s got solid options, from local names to global players. The best brokers understand your world—ZAR accounts, JSE stocks, and payments that don’t sting. Whether you’re chasing forex or local indices, there’s a platform for you. Let’s break it down.

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| No fees | CFDs (Forex 100+ pairs, Cryptos, Commodities, Indices, Stocks) | $10 | Up to 1:2000 | MT4 MT5 Exness Terminal Exness Trade App | ||

| No commission | Currency pairs Commodities Cryptos OTC | $5 | 1:10 to 1:1000 (MT5 Forex, deposits >$1,000) | MT5 Proprietary web Mobile | ||

| No trading/deposit/withdrawal fees | Currency pairs Commodities Cryptos Indices (43 total) | $10 | Not available | Proprietary browser platform Android app | ||

| Spread: 1.7-1.9 points; Withdrawal: 2% | CFDs (Stocks, ETFs, Commodities, Indices, Cryptos, Forex, Options) | $10 | Up to 1:500 (Forex) | IQ Option proprietary Mobile | ||

| Up to 15% standard trades, 10% FTT | Forex CFDs Stocks Indices Commodities Cryptos ETFs OTC Fixed Time Trades | $10 | Varies by region/market | Olymptrade (web, desktop, mobile) No MT4/cTrader |

FSCA-Regulated Options

FSCA-regulated brokers are your safest choice. They’re held to high standards, so you’re less likely to get burned. Exness, Deriv, and Pocket Option all carry robust regulatory credentials. They offer binary options alongside forex, stocks, and commodities, with tools for newbies and veterans alike. These platforms are built for South Africans—local support, familiar assets, and peace of mind.

Deriv is a standout. It’s got ZAR accounts, so you skip conversion fees. Withdrawals hit your bank fast—sometimes same-day to FNB or Absa. Their platform is smooth, with JSE stocks and USD/ZAR for binary trades. Pocket Option keeps it simple, offering binaries on forex, indices, and local shares like MTN. Their charts help you spot trends, and support speaks English or Afrikaans. Exness is a favorite for beginners—low deposits start at $10, plus free webinars to learn the ropes.

No broker’s perfect. Fees can creep up, especially on inactive accounts. Spreads might widen during volatile markets. But strong regulation means these platforms are transparent about costs. You’re trading with a safety net.

Why pick FSCA brokers:

- Support gets SA’s market and language.

- Funds stay secure—always a priority.

- Local assets like JSE Top 40 available.

- No ownership—just predict price moves.

FSCA Regulation and Oversight

The Financial Sector Conduct Authority (FSCA) is South Africa’s financial watchdog. It’s there to keep brokers honest. FSCA-regulated platforms follow strict rules, like keeping your money in separate accounts. That means if the broker goes bust, your funds stay safe. They also face audits, so shady tricks get caught fast. It’s not perfect, but it’s a solid safety net.

Why’s this matter to you? Unregulated brokers can be a disaster. Some vanish with your deposits or slap on hidden fees. An FSCA license shows a broker’s serious—they’re playing by the rules. You can check their license number on the FSCA website in seconds. Don’t fall for flashy ads from unlicensed platforms. Big bonuses often hide bigger risks.

Trading with an FSCA broker feels different. You’re not watching your back every second. Platforms like Exness carry that license, giving you confidence to focus on trades, not tricks. Always verify regulation before signing up—it’s your money on the line.s my first choice for small trades.

| FSCA Benefit | Why It Helps You |

| Segregated Accounts | Your cash stays safe if broker fails |

| Transparent Fees | No surprises eating your profits |

| Dispute Resolution | A way to fix issues fairly |

Leading Binary Options Platforms for South Africans

Your broker is your trading lifeline. A good one makes everything click—fast trades, clear charts, quick payouts. A bad one? It’s like driving with a flat tire. South Africa’s got solid options, from local names to global players. The best brokers understand your world—ZAR accounts, JSE stocks, and payments that don’t sting. Whether you’re chasing forex or local indices, there’s a platform for you. Let’s break it down.

FSCA-Regulated Options

FSCA-regulated brokers are your safest choice. They’re held to high standards, so you’re less likely to get burned. Exness, Deriv, and Pocket Option all carry robust regulatory credentials. They offer binary options alongside forex, stocks, and commodities, with tools for newbies and veterans alike. These platforms are built for South Africans—local support, familiar assets, and peace of mind.

Deriv is a standout. It’s got ZAR accounts, so you skip conversion fees. Withdrawals hit your bank fast—sometimes same-day to FNB or Absa. Their platform is smooth, with JSE stocks and USD/ZAR for binary trades. Pocket Option keeps it simple, offering binaries on forex, indices, and local shares like MTN. Their charts help you spot trends, and support speaks English or Afrikaans. Exness is a favorite for beginners—low deposits start at $10, plus free webinars to learn the ropes.

No broker’s perfect. Fees can creep up, especially on inactive accounts. Spreads might widen during volatile markets. But strong regulation means these platforms are transparent about costs. You’re trading with a safety net.

Why pick FSCA brokers:

- Funds stay secure—always a priority.

- Local assets like JSE Top 40 available.

- Support gets SA’s market and language.

International Brokers Accepting South African Clients

Not every great broker is local. Global platforms like IQ Option and Olymp Trade open doors to South Africans. They bring assets you won’t always find at home—think Tesla stocks, crypto, or exotic forex pairs. The trade-off? Not all have FSCA licenses. You’ve got to check their regulation elsewhere, like CySEC or FCA.

IQ Option’s a crowd-pleaser with a $10 minimum deposit. It’s great for starters—their app’s easy, with tutorials to guide you. Binomo shines for flexibility. You can trade binaries from 30 seconds to a week, picking what suits your style. Both accept South Africans and handle ZAR payments, though conversion fees might apply without ZAR accounts.

Be picky with international brokers. Read reviews from SA traders on forums or social media. Test their support—do they understand your needs? A demo account shows you their speed and setup. Global platforms can boost your game, but don’t skip the homework.

ZAR Account Support

Trading in South African Rand (ZAR) is a must. It saves you from exchange rate headaches and bank fees. Exness, Quotex, and IQ Option offer ZAR accounts, letting you deposit, trade, and withdraw in your home currency. Every rand counts when you’re building your account.

ZAR accounts keep it real. You know exactly what you’re risking or earning. Trading USD/ZAR and getting paid in rands? That’s smooth. Exness makes withdrawals a breeze—money hits your Absa account fast. IQ Option pairs ZAR with JSE stock binaries, so you’re trading local without extra costs. If a broker doesn’t offer ZAR, you’re stuck with conversions that chip away at profits.

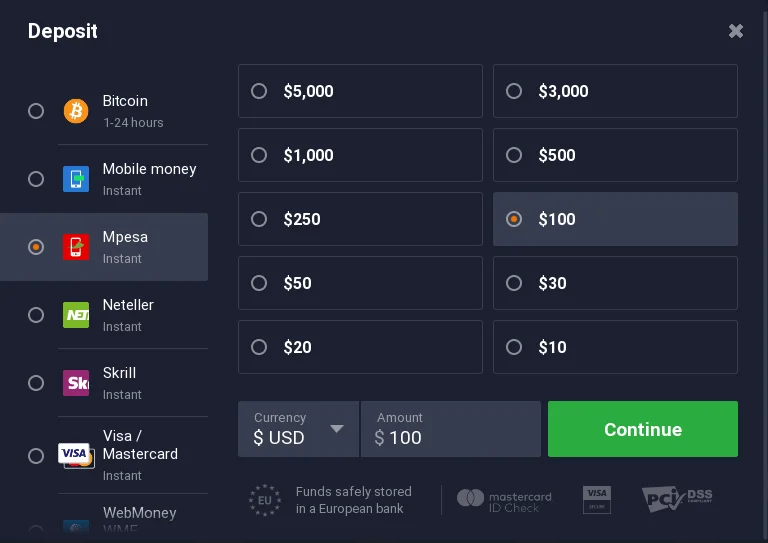

South African Payment Methods for Binary Trading

Getting cash in and out should be painless. South African traders have solid options—bank transfers, cards, e-wallets, even crypto. The best brokers keep fees low and process fast. Whether you’re funding R200 or R2000, you want it smooth. Here’s what fits your wallet.

EFT and Bank Transfers

Electronic Fund Transfers (EFTs) are South Africa’s go-to. They’re safe and work with banks like FNB, Standard Bank, or Nedbank. Exness and Quotex accept EFTs—deposits land in 1-2 days. Withdrawals take 2-3 days, sometimes less with Exness to Capitec. Most brokers skip fees for local banks, which is a win.

EFTs are steady but not instant. If you’re itching to trade, plan ahead. Double-check the broker’s bank details—mistakes delay everything. It’s old-school, but it gets the job done.

South African Credit/Debit Cards

Visa and Mastercard are quick and easy. Deposits hit your account in seconds with Pocket Option, Exness, or IQ Option. Withdrawals take 1-4 days—FNB’s usually fastest. Your Absa debit or Standard Bank credit card should work fine.

Cards aren’t flawless. Some brokers charge 1% per transaction. Banks might block big international payments, so check your limits. Exness keeps card deposits free, which helps. For speed, cards are tough to beat.

| Method | Deposit Speed | Withdrawal Speed | Fees |

| EFT | 1-2 days | 2-3 days | Free |

| Cards | Instant | 1-4 days | 0-1% |

Popular Local E-Wallets

E-wallets like Skrill and Neteller are trader favorites. They’re fast—deposits are instant, withdrawals clear in 24 hours. Exness and Olymp Trade support both, letting you keep trading funds separate. Fees run 1-2%, but the speed’s worth it.

Local wallets like Ozow aren’t big in binary trading yet. Skrill’s global reach makes it king. Exness waives Skrill deposit fees for South Africans, a nice touch. E-wallets give you control without bank hassles.

Top e-wallets:

- Skrill: Quick, secure, everywhere.

- Neteller: Fast payouts, trusted.

- Payz: New but growing option.

Cryptocurrency Options for South Africans

Crypto’s gaining ground. Bitcoin or Ethereum deposits are fast and private—no bank needed. Binomo leads here; Exness is dipping in. Funds clear in 10-60 minutes. South Africa’s crypto scene, with platforms like Luno, makes this easy.

But crypto’s tricky. Prices swing, so your deposit’s value might shift. Not all brokers offer crypto withdrawals—ask first. Start small to test the waters. It’s a bold move for tech-savvy traders.

| Payment Method | Deposit Speed | Withdrawal Speed | Fees |

| EFT | 1-2 days | 2-3 days | Free |

| Cards | Instant | 1-4 days | 0-1% |

| E-Wallets | Instant | 24 hours | 1-2% |

| Crypto | 10-60 minutes | Varies | Network fees |

Pick what fits—speed, cost, or privacy. Good brokers make it all work.

Trading South African Markets with Binary Options

South Africa’s markets are alive with action. Binary options let you trade JSE stocks, indices, forex, or gold without buying anything. It’s all about smart timing. From Johannesburg’s giants to global commodities, you’ve got plenty to play with. Here’s how to make it count.

JSE-Listed Companies

The JSE’s home to big names—Naspers, MTN, Anglo American. Binary options let you bet on their price moves in short windows, like 5 or 30 minutes. Exness and IQ Option offer binaries on top JSE stocks. You’re trading brands you know, which feels good.

Naspers swings with global tech news. MTN tracks SA’s economy. Stick to liquid stocks—they’re easier to predict. Smaller firms can jump around too much. Check your broker’s list to see what’s on tap.

Johannesburg Stock Exchange Index

The JSE Top 40 Index bundles SA’s biggest firms—banks, miners, retailers. It’s a quick way to trade the market’s mood. Think it’ll climb after a mining rally? Or drop on US trade news? Binaries let you act fast.

Exness and Pocket Option offer JSE Top 40 options with tight spreads. Expiry times range from minutes to hours. The index moves on SARB rates or global events. Watch news closely—volatility is your friend or foe.

| Index | What Drives It | Trade Tip |

| JSE Top 40 | SARB, commodities, global markets | Check economic calendars |

USD/ZAR Currency Options

USD/ZAR is South Africa’s forex king. The rand’s a rollercoaster—up one day, down the next. Binary options let you pick its direction against the dollar. Will it rise after a trade deal? Or fall on political drama? You decide.

Exness keeps USD/ZAR trades sharp, with low costs. Binomo’s good too. The pair reacts to US data, SARB moves, or gold prices. A rate hike can spark action. Stay glued to alerts for big swings.

USD/ZAR movers:

- SARB interest rate calls.

- US jobs or inflation reports.

- Commodity shifts like gold.

Commodity Options Relevant to SA Economy

South Africa thrives on commodities—gold, platinum, oil. Binaries let you trade them without storage hassles. Gold’s a safe bet when markets panic. Platinum rides mining and car demand. Oil hits the rand hard.

Quotex and IQ Option offer commodity binaries with short expiries. SA strikes can spike platinum; global supply news moves oil. Use charts—RSI or moving averages—to time entries. News is your edge.

Gold

- SA Link: Major export

- Key Triggers: Global risk, dollar moves

Platinum

- SA Link: Mining leader

- Key Triggers: Strikes, auto sales

Oil

- SA Link: Impacts rand, costs

- Key Triggers: OPEC, global demand

Commodities tie SA to the world. Trade them with care.

Mobile Trading Apps for South African Conditions

South Africans trade on the go—cafes, taxis, or rural spots. But networks can be shaky. You need apps that work fast, even on 4G. Exness, Olymp Trade, and IQ Option deliver. They’re built for SA’s real-world conditions—quick trades, clear charts, no crashes.

Exness’ app handles ZAR and JSE stocks smoothly. Olymp Trade packs indicators for deep analysis. IQ Option’s app is great for beginners, with built-in guides. Battery drain’s a killer, so check reviews from SA traders. A good app keeps you trading, no matter what.

| Broker | App Strengths | Best For |

| Exness | ZAR, JSE, fast | Local traders |

| Olymp Trade | Charts, tools | Technical pros |

| IQ Option | Simple, guides | Newbies |

Demo Accounts for South African Traders

Demo accounts are your no-risk training ground. You trade real markets with fake money. Exness, Pocket Option, and Deriv offer demos with JSE stocks and USD/ZAR. It’s the best way to learn platforms or test ideas without losing cash.

Exness’ demo feels like live trading—same spreads, same assets. Pocket Option adds free tools to practice charting. Spend weeks trying strategies like trend-following. Demos build confidence, so don’t skip them.

Binary Options Education for South Africans

Knowledge is power in trading. South Africa’s markets—JSE, rand—need specific know-how. Exness offers free videos on USD/ZAR. IQ Option’s webinars break down local stocks. They explain tools like candlesticks or MACD in plain words.

Don’t stop there. Read Fin24 or Moneyweb for SA news. Join trader groups online for tips. Start with basics—support, resistance—then try scalping or breakouts. Learning never stops if you want to win.

Learning spots:

- Exness: Forex and JSE courses.

- IQ Option: Live market talks.

- Moneyweb: Free SA updates.

Tax Implications for South African Binary Traders

SARS doesn’t miss binary profits. They’re taxed as income—18% to 45%, based on your earnings. Full-time traders face higher rates; part-timers might pay less. Either way, you declare it all. No exceptions.

Track every trade—wins, losses, fees. A spreadsheet’s fine; apps like TaxTim help too. SARS audits are real—sloppy records mean trouble. Got questions? A tax pro who knows trading can save you stress. It’s part of the game.

Low Minimum Deposit Options for South Africans

You don’t need deep pockets to trade binaries in South Africa. Low minimum deposit brokers let you start small—perfect if you’re testing the waters. From R100 to R1,000, there’s something for everyone. The key is picking a platform that’s legit and works for you. Let’s look at options and strategies to grow small accounts.

Brokers with R100-R500 Minimum Deposits

Starting with R100-R500 is easy with the right broker. These platforms keep costs low and give South Africans access to forex, JSE stocks, or gold. They’re great for learning without big risks.

Exness kicks off at R150 ($10). You get ZAR accounts, quick withdrawals to FNB, and binaries on USD/ZAR. Binomo’s even cheaper—R100 ($5)—with free guides for newbies. IQ Option, an international name, starts at R150 and has a smooth app. Watch out for fees—spreads can hit small accounts hard.

R500-R1,000 Deposit Range Platforms

Got R500-R1,000? You’re in a sweet spot. These brokers offer better tools—like sharp charts—while staying affordable. It’s low-risk with more room to trade.

Quotex starts at R1,000 ($100). It’s internationally regulated, with binaries on JSE stocks like Sasol. Exness works too—R500 unlocks JSE Top 40 options. Olymp Trade begins at R500 with ZAR accounts. Fees matter—Olymp Trade’s withdrawals might cost below R500. Choose what fits your style.

| Broker | Minimum Deposit | Standout Features | Regulation |

| Quotex | R1,000 | JSE stocks, great charts | International |

| Exness | R500 | Quick payouts, ZAR accounts | Multiple jurisdictions |

| Olymp Trade | R500 | Free webinars, low spreads | International |

Trading Strategies for Small South African Accounts

Small accounts need smart moves. Risk too much, and you’re out fast. With R100-R500, focus on simple strategies that work for South Africa’s markets—like USD/ZAR or JSE stocks.

Risk 1% per trade—R5 for a R500 account. It keeps you trading longer. Try trend-following: if MTN’s climbing on good news, bet it’ll keep going. Use a 20-day moving average to confirm. Scalping’s good too—grab R10-R20 on USD/ZAR during US news. Stick to liquid assets like gold; they’re safer. Practice on Exness’ demo first. Stop when you hit 5% daily gains. Patience builds accounts.

Frequently Asked Questions

Binary trading raises questions for South Africans. Is it legal? How’s it taxed? Can you trade JSE stocks? Here are clear answers to help you navigate.

Is binary options trading legal in South Africa?

Yes, it’s legal. Financial regulations allow it, so stick to brokers like Exness or Pocket Option. They’re safe. Unlicensed platforms? Big risk—avoid them.